Lucara Finds Massive 2,492ct Rough

Lucara, the Canadian mining company operating the Karowe mine in Botswana has announced the recovery of an exceptionally large 2,492ct diamond. The mine is renowned for exceptional and large diamonds of high quality, including the the 1,758 carat Sewelô and the 1,109 carat Lesedi La Rona.

Botswana Eyes Bigger Stake in HB Antwerp

According to JCK News, Botswana's mining minister Moagi told local parliament that the government is looking into increasing a planned buy-in of HB Antwerp, originally stated to be 24% for US$65m, implying HB Antwerp's valuation stood at US$278m at that time. According to Moagi, that same amount of investment would now warrant a 49.9% stake, citing the current depressed market as a reason for HB Antwerp's value to have decreased.

De Beers Reschedules Sights, Kiran Extends Holiday to Ease Oversupply

In an announcement to its clients, De Beers has announced it is rescheduling sights to alleviate market pressure caused by decreased demand and a supply glut. Sights 7 and 8 will be combined at the end of September and Sight 9 and 10 dates are amended to accommodate timing issues in Botswana, to November 4-8 and December 2-6.

Petra Postpones South Africa Tender

In a letter to its clients, Petra Diamonds has announced it is postponing its August viewing and sale of South African production in Johannesburg until further notice, to avoid unnecessary supply of rough to the market, which has been suffering from weak demand for several months now.

Debswana H1 Sales Drop 49,2%

Reuters reports that the 50/50 Government of Botswana and De Beers owned mining entity Debswana has seen sales nearly halved in the first half of this year, selling US$1.29bn compared to US$2.54bn last year. Currently, the company sells 75% of its production via De Beers, the remainder is allocated to Okavango Diamond Company (ODC). Under the new contract, ODC's share is set to be increased to 50% of Debswana's production by the end of the 10-year agreement.

De Beers Facing Sharp Drop Of Revenues

De Beers reported a significant revenue decline for the first half of 2024. According to the company's latest financial statement, revenue fell by 21% to $2.2 billion compared to the same period last year.

The sharp drop is due to several converging factors affecting the diamond industry. De Beers, known for its vast mining operations and luxury retail presence, has faced headwinds from reduced consumer demand, fluctuating diamond prices, and increased competition from lab-grown diamonds.

Budget 2024: Game Changer For Indian Diamond Industry

In India, there is a very positive reaction to the Budget 2024 announcement by Finance Minister Nirmala Sitharaman.

This announcement is very important for the Indian diamond industry. It includes the abolition of the 2% equalization levy on rough diamond imports and the establishment of Special Economic and Notified Zones, which allows foreign diamond-producing companies to sell their diamonds directly to the diamond-cutting and manufacturing entities in India.

Burgundy Eyes Misery Mine Life Extension

Australian miner Burgundy Diamond Mines, operating the Ekati mine in Canada's Northwest Territories is looking at the potential to extend the Misery underground mine's life beyond the anticipated 2025 end of life date. Extension drilling is ongoing to assess whether the main ore body is deeper and wider than originally assumed. Updated resource estimates are expected to be announced later this year, with an updated mine plan.

Photo credit: Burgundy Diamond Mines

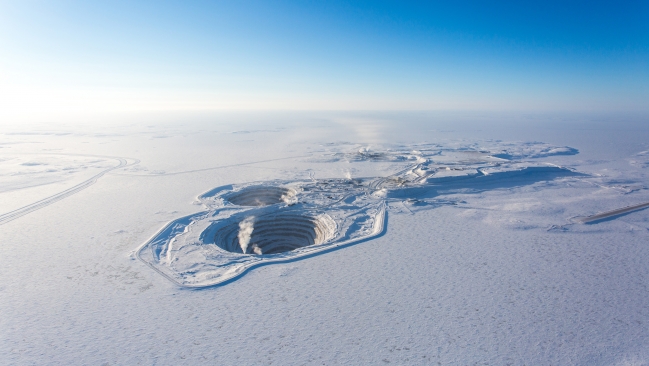

Russia Jumped Over Botswana as Largest Producer in Value in 2023

According to recently released Kimberley Process statistics, in 2023, Russia became the largest producer of rough diamonds in terms of value, jumping over Botswana, despite sanctions on Russian diamonds by the G7. Total value of Russian rough production amounted to US$3.61bn, for a volume of 37.3m ct, compared to Botswana's total production value of US$3.28bn, for a total of 25.1m ct.

Photo credit: Envato Elements

Lucapa Mothae (Lesotho) Mine Sale Takes Shape

Lucapa announces a conditional Sale and Purchase agreement has been reached with Lephema Executive Transport Ltd, having provided long-term mining services to the mine, for its 70% stake in the Mothae mine in Lesotho. Mid May, Lucapa announced its plans to divest the Lesotho operation in favor of focusing on the miner's assets in Australia and Angola.

Gem Diamonds Recovers 172.06ct Type II Diamond

Gem Diamonds has announced the recovery of an exceptional 172.06ct Type II white rough diamond, the seventh 100+ct diamond recovered at its Letšeng mine this year alone.

Mission Masisi at JCK Las Vegas: Safeguarding the Future of Botswana

In a surprising move, Botswana President Masisi yesterday left the country to join industry stakeholders at the 2024 JCK Las Vegas show. Botswana finds itself in the middle of a perfect storm of challenges: De Beers' parent company Anglo American recently became the target of potential take-over bids, which led to Anglo announcing plans to spin off its diamond business.

Letšeng mine in Lesotho delivers 212.49ct Type II White Diamond

Gem Diamonds Limited, the company that owns 70% of the Letseng mine in Lesoto, announced today the discovery of a 212.49ct Type II White Diamond. This remarkable stone was brought to the surface on May 28 and it is the sixth diamond weighing more than 100 carats to be unearthed this year from that mine.

Rare 195 Carat Type IIa Diamond Discovered At Lulo Alluvial Mine In Angola

Lucapa Diamond Company announced yesterday the recovery of a 195 carat diamond, discovered in the Lulo Alluvial Mine in Angola. It involves a type IIa diamond, which occurs only very rarely in nature. Special about this type of diamonds is the fact that they have no measurable nitrogen or boron impurities, making them the most chemically pure diamonds with the highest thermal conductivity that exists. Mostly these diamonds are colorless, but they can also be gray, light brown, light yellow or light pink.

4th De Beers Sales Cycle Drops 21% y-o-y

De Beers 4th sight cycle revenues totaled US$380m, a 21% drop from US$479m achieved in the 4th cycle of 2023 and -15% from sight n°3 this year, translating in a 17% decrease in revenues from sales (US$ 1.63bn this year vs US$1.97bn in 2023) year-to-date. The lower sales figures correspond with current market sentiment and add to the turbulence surrounding a potential sale of the diamond entity of Anglo American.

Photo credit: Anglo American Plc

Lucapa To Sell Lesotho Mothae Mine

Lucapa, the Australian listed miner with operations in Angola (Lulo) and Lesotho (Mothae) is looking to divest its 70% stake in the Mothae mine after a review of its asset portfolio by the recently restructured Lucapa board of directors.

Lucara Reports Robust Q1 Results

Lucara Diamond in its Q1 2024 release reports total revenues of US$41.1m, slightly down y-o-y from US$42.8m. A total of 93,560ct were sold through its different sales channels, including through the renewed 10-year sales agreement with HB for specials (10.8ct+ rough diamonds) produced, with so-called "top-up payments" resulting in US$4.9m of the total revenues. In total 160 "specials" (5.1% of total cts) were recoverd in Q1, 3 of which larger than 100ct and one larger than 300ct.

Alrosa Stake Catoca (Angola) For Sale

According to Interfax, quoting Russia's Ministry of Finance Moiseyev, Alrosa will have to sell its stake in Angola's Catoca operation, as pressure from the West on the Angolans mounts to cut ties with Russian, sanctioned entities. According to Moiseyev negotiations to take over Alrosa's share, which originally stood at 41% of the mining operation, are ongoing with "friendly investors".

Burgundy Starts Strong in Q1

Burgundy Diamond Mines, reports strong results for Q1 2024 despite a subdued rough and polished market, with record revenues of US$117m for 1.32m cts sold (+65% in volume y-o-y). CEO Kim Truter cites Burgundy's consistent diamond quality and provenance assurances as key drivers for strong buyer interest. In Q1, Burgundy recovered 1.15m carats, including a 23.15ct fancy intense yellow.

Photo credit Burgundy Diamond Mines

Lucapa Q1 Results Down, Q2 Starts Promising

Lucapa, operating the Lulo mine in Angola and Mothae in Lesotho, reports Q1 results were down with revenues clocking at US$13.1m, down 28% y-o-y, and rough prices down 41%, from avg 1,350US$/ct to 798US$/ct. Lulo production focused on lower grade areas due to flooding, resulting in low grades in carats recovered, while Mothae production improved in terms of carats recovered but with a significantly lower frequency of exceptional, high value diamonds.

De Beers Relocates Auction HQ to Botswana

De Beers Group has moved its Auction business headquarters from Singapore to Botswana, aiming to boost operational efficiency. CEO Al Cook expressed confidence in the move's potential to drive cost efficiencies and elevate customer satisfaction.

Petra Diamonds Soars with $8.2m Blue Diamond Sale

Petra Diamonds recently made headlines with the sale of an exceptional US$8.2 million blue diamond, propelling its fifth tender of FY 2024 to new heights. Despite selling fewer carats, Petra achieved higher prices, with an average of US$136 per carat on sales of 362,000 carats, totaling US$49 million.

Gem Diamonds Q1 Reports and Recoveries

Gem Diamonds, who owns 70% of the Letšeng mine in Lesotho, has released its Q1 2024 Trading Update, which showcases robust operational and sales performances from January 1st to March 31st, 2024.

Key Highlights from Q1:

De Beers' Fate Uncertain as BHP Considers Anglo American Takeover

According to Reuters, Australian mining giant BHP is contemplating a potential takeover of London-listed Anglo American, parent company of De Beers, news that is confirmed by Anglo American in a statement saying the bid is being reviewed.

3 Diamonds Fetch $10.5 Million at Lucapa Tender

ASX-listed Lucapa Diamond Company announced that three exceptional diamonds achieved US$10.5 million at the first tender of Lulo diamonds for 2024.

Namdia to Invest 3.4bnUS$ in Local Diamond Industry

Namibian Mining News reports that at Mining Indaba, Namdia has unveiled plans to invest a massive 3.4bn US$ over the next ten years, expanding its operations, including through social responsiblity actions in its "Equitable Economic Empowerment Framework" and renewing its focus on exploration, aligned with more accessible and up to date exploration licenses and mining rights information via an e-platform. Namibia, ramping up its activities in green energy rapidly, is a mineral-rich country with huge potential in critical minerals such as lithium and rare earths.

Diamcor Begins Bulk Sampling into Greater Areas of its Krone-Endora at Venetia Diamond Mine Project

Canadian mining company Diamcor announced that it will be proceeding with an extensive drilling and bulk sampling program over the greater portions of its Krone-Endora at Venetia diamond mine project.

108 Carat Fancy Intense Pink Diamond Discovered in Lesotho at SMD Kao Mine

Storm Mountain Diamonds announced yesterday the recovery of a rare fancy intense pink diamond weighing 108.39ct at its Kao mine in the Kingdom of Lesotho. The stone was discovered earlier this year on March 23rd, 2023.The exceptionally rare Type IIa gemstone is one of the largest pink diamonds in history to have been recovered.

Mountain Province Diamonds Optimistic about Kelvin and Faraday Kimberlite Studies: Over 18 million Carats Present

Mountain Province Diamonds, a 49% participant with De Beers Canada in the Gahcho Kué diamond mine located in Canada's Northwest Territories made their Q1 Reports for the spring season of 2023.

Lucapa Reports Record Numbers Once Again During Q1-2023

Angolan mining company Lucapa has posted their Q1 reports for this year with many positive highlights. At its Lulo operation, there has been a new record set in volumes mined, with an 11% increase in tonnage, resulting in over 591,00 tons processed, up from 533,000 tons processed at the same time last year. The mine also reported the recovery of a 150 carat Type IIa diamond and several fancy-colored stones - three diamonds, including two +100 carat diamonds, which will be held back from normal sale for a planned tender.

NAMDIA Establishes Formal Relations with Angolan State-Owned Companies ENDIAMA and SODIAM

The CEO of Namibia Desert Diamonds (NAMDIA) expressed interest to work with the Angolan diamond companies after a recent visit from the Angolan Minister of Mineral Resources, Petroleum and Gas, Dr Diamantino Pedro Azevedo, at the NAMDIA Headquarters. Their talks highlighted the potential Namibia and Angola has in promoting the region’s diamonds to generate even greater value for Namibia and Angola, both of which are alluvial-producing countries.

GEM Diamonds Remain Optimistic for 2023 Despite Share Prices Declining to Lowest Point Over Last Year

Clifford Elphick, CEO of GEM Diamonds said in an announcement on Thursday (March 16) that market volatility caused by the invasion of Ukraine by Russia contributed to a decline in diamond prices. GEM achieved an average selling price of $1,755 per carat compared to $1,835 per carat in 2021. Though he remains overall optimistic regarding the mine’s capacity to rebound during the 2023 fiscal year.

They reported a 31% decline in attributable profit for the 12 months ended December 12 of $10.2m compared to $14.8m in the previous financial year.

Petra Achieves $72.1 million in Sales in Fourth tender Cycle for FY 2023

Petra announces the results of Tender 4 of FY 2023, at which 505,398 carats were sold for a total of US$72.1 million from Petra’s South African operations.

This cycle includes a US$7 million Exceptional Stone2 from the Cullinan Mine and US$4.3 million of Finsch diamonds sold during H1 FY 2023, both of which were reported in our Interim Results announcement during February 2023. No sales for Williamson were recorded in this cycle given the operations at the mine are still suspended.

Burgundy Diamonds Acquires 100% of Artic Canadian’s Assets Including Ekati Mine

Australia-based Burgundy Diamond Mines has signed a binding share purchase agreement to acquire Canada-based Artic Canadian’s (AC) assets, including the entirety of Ekati Diamond mine, for nearly $136m. AC owns 100% of all businesses, assets and other interests comprising the producing Ekati mine in Canada’s Northwest Territories and expects the sale to result in a significant recapitalization of the firm and allow for continued operations for the Ekati Diamond Mine, which has been in production for nearly 25 years.

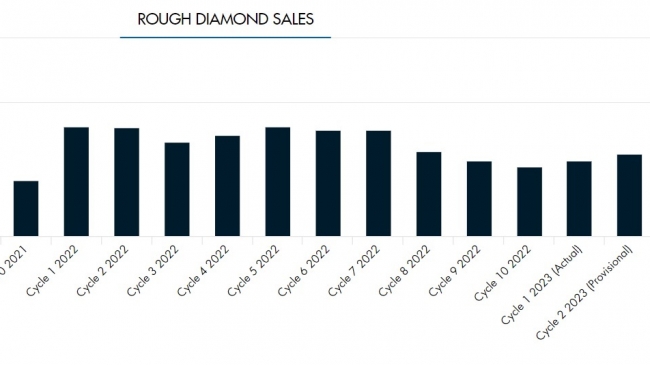

DeBeers Posts $495 Million Earnings Rough Diamond Sales in Cycle 2 - 2023

De Beers Group yesterday announced the value of rough diamond sales for the second sales cycle of 2023. The mining giant sold $495 million in rough stones. There was a noticeable year-over-year drop in sales when compared with 2022- Cycle 2, where the company sold over $652 million, a 24% fall. Sales were 9% higher than $454 million registered for the preceding first Sight of 2023.

Homestead Diamonds Recovers Type-IIa 13-carat Pink Diamond at Samanda Mine (South Africa)

Homestead Diamonds has recovered a rare 13-carat pink diamond from its bulk sampling operation on the Samada kimberlite pipe in the Free state province of South Africa. The 13.33-carat Pink is a Type IIa diamond and is one of several exceptional fancy colour stones recovered since the commencement of the bulk sampling programme in 2020.

Rio Tinto Invests $40 Million into Underground Mining Operation at Diavik

Rio Tinto has made $40 million investment in the first phase of underground mining below the existing A21 open pit at its Diavik Diamond Mine which started commercial production in 2018 in the Northwest Territories of Canada. The Diavik mine, Canada’s largest mine produces on the order of 6.5 million carats (+/-) of rough diamonds per year and has unearthed more than 100 million carats since its opening.

Lucara Underground Mine Expansion Progresses at Karowe Mine with Anticipated Full Production by 2026

Lucara Diamond has published an updated report on the progress of its underground expansion project at Karowe diamond mine in Botswana.

The expansion will extend the life of the mine to at least 2040 and contribute $4 billion in additional revenues. Mine ramp up is expected in 2026 with full production from underground to be reached in the second half of that year.

150 Carat Diamond Recovered by Lucapa in Angola

Lucapa Diamond Company Limited together with Lulo partners, Endiama and Rosas & Petalas, have announced today the recovery of a 150-carat white Type IIa diamond from the Lulo Alluvial Mine in Angola. This stone represents the the 36th +100-carat diamond recovered at Lulo. The 150 carat diamond was recovered from Mining Block 28 (“MB28”) and is the fifth +100 carat diamond recovered from that particular mining block.

Petra Posts Interim results for the 6-Months Ending 31 Dec 2022

(PETRA PRESS RELEASE): Petra Diamonds Limited announces its unaudited interim results for the six months ended 31 December 2022.

Richard Duffy, Chief Executive Officer at Petra Diamonds commented:

Arctic Canadian, Taché & Samir Gems Work Responsibly with Largest Fancy Vivid Yellow Diamond Ever Discovered in Canada Making History in the Process

[A DIAMOND LOUPE EXCLUSIVE STORY] - It was only just last September that Canadian mining company Arctic Canadian (AC) announced the recovery of a yellow diamond weighing an impressive 71.26 carats. The rough octahedron gem is currently the largest known fancy vivid yellow diamond ever discovered in Canada.

De Beers Reports Increased Diamond Production in Botswana & Namibia Despite Dip in Polished Demand

Rough diamond production increased by 6% to 8.2 million carats, reflecting strong operational performance across the assets, partially offset by the planned completion of the final cut at Venetia open pit.

Debswana Sets Record with Sales of Rough Stones During 2022

Rough diamond sales by Debswana Diamond Company reached record levels in 2022 jumping up by 22% from the previous year. The jump in sales has resulted from the West’s shunning of Russian stones whereby Botswana profited from steady global demand for diamond jewellery.

Lucapa Releases Q4-2022 Results Featuring New Growth and Recovery of Special Sized Diamonds

Lucapa has released the results of its fourth quarter of activity during the last year. According to a company press release, record volumes were processed last quarter, recovering four +100 carats including several fancy-colored stones valued at over $5.9 US million were set aside for a Lulo exceptional stone tender.

Barton Gold Completes First Drilling for Diamonds in Australia’s Tunkillia Mines

Barton Gold has announced that they have just completed a diamond drilling program at the Tunkillia project in South Australia. The company had announced its plans to diversify it’s mining activities last September in a press release stating that “as the footprint of this project grows with each program, we are increasingly excited about the scale potential of this system.”

The 2200-meter program targeted depth extensions of the 223 deposit and the Area 51 zone of an established gold mine, however this time prospecting for diamonds.

Antwerp Based Signum Initiates New Business Model of Selling Rough Stones and NFT’s B2C

Belgium based company Signum who was known for pioneering on the NFT side of the diamond trade developing a blockchain style ledger to prove diamond authenticity, now intends on incorporating the sale of rough stones directly to the public along with its digital companion into their business model.

“We are aiming to create a new product and a new market,” Rafael Papismedov, co-founder and managing partner of Signum.

Tanzania Reports Record $63 Million in Diamond Exports Despite Williamson Mines Closure

The Bank of Tanzania announced that the country’s diamond exports increased significantly to $63.1 million (USD) in value by November 2022. This is more than seven times of the $8.4 million export value that was recorded in the year-over year analysis since November 2021.

Lucapa Recovers 2 Special Sized Diamonds in Recent Exploration

Lucapa Diamond Company Limited together with their Project Lulo partners, Endiama and Rosas & Petalas, have recovered a total of 41 diamonds weighing 66.05 carats in a recent kimberlite sample.

The sample also includes two special sized diamonds weighing 15.27 and 12.37 carats, with 12 diamonds greater than one carat recovered totaling of 50.21 carats.

Sarine Technologies and Delgatto Diamond Finance Fund Revolutionize Rough Diamond Financing in New Collaboration

Sarine Technologies has signed a strategic cooperation agreement with the Delgatto Diamond Finance Fund (DDFF) that will enable DDFF to “significantly” increase the amount of capital it provides to the rough sector, as well as expand the types of structures it offers enable more efficient rough diamond financing, starting from January 15th.

Blue Rock Diamonds Overcomes Production Troubles Caused by Excessive Rain in Q4-2022

BlueRock Diamonds says it has finally gotten through the last of the problems that cut its processing production by over 30% caused by unseasonable rains that flooded the country last

April and again in October through November. In an update posted by London-based miner the company confirmed it was now back to normal production levels, even during a particularly rainy fourth quarter.

DeBeers’ Auction Sales Soar at the End of 2022

Global diamond group DeBeers has reported an over 20% bump in auction sales towards the closing of the 2022 sales year during its 10th and final yearly sales cycle. The mining and trading firm sold £340million of the gems at its auction in December – up from £279million in December 2021.

Before the pandemic, diamond prices were falling as the market struggled with oversupply, economic slowdown in China, and a global squeeze on luxury goods spending. The estimated sales at the December auction were down 10 per cent on the November auction, where the firm made £377million.

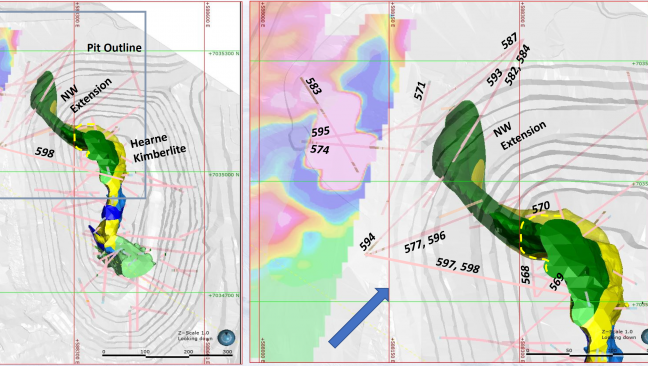

Mountain Province Diamonds Completes Phase One Drilling for the Hearne Northwest Extension Discovery at Gahcho Kué Mine

The Hearne kimberlite is one of four kimberlites being mined at Gahcho Kué Mine, which is presently ranked as 4th in the world by annual diamond production. Mountain Province is a 49% shareholder at Gahcho Kué with joint venture partner De Beers Canada as operators.

Golden Canary Breaks Records As 3rd Most Valuable Diamond Ever Sold at Auction

Sotheby’s got $12.4 million for the 303.1 ct. Golden Canary—the recut version of the Incomparable—making it the third most valuable yellow diamond ever sold at auction. The Golden Canary is a Fancy Deep Brownish Yellow color and is considered the largest internally flawless diamond in the world.

The story of the Golden Canary’s discovery is also quite captivating.

DeBeers Strikes Out on Exceptional Blue Collection Sales at Latest Auction – May Indicate Drop in Demand for Blue Stones

De Beers had two more strikeouts with its Exceptional Blue Collection recovered in Petra’s South African Cullinan mine, this last Dec. 7 - perhaps a harbinger of waning demand in the colored diamond auction market.

Rough Diamond Prices Expected to Hold in FY2024

Rough diamond prices are likely to remain firm in FY2024 as no major ramp-up in mining output (of rough diamonds) is expected over the next two years. This, coupled with recessionary pressures, shall continue to exert pressure on the revenues and profit margins of Indian cut and polished diamond (CPD) entities in FY2024, according to credit rating agency ICRA.

Botswana Diamonds Remains Optimistic for 2023

Declaring a slight -0.09% loss on the GBX in 2022, Botswana Diamonds (BD) remains optimistic regarding their latest strategy of acquiring existing lots from former mining exploitations. This year alone the company has increased its stake to 50% in the Maibwe joint venture by acquiring a stake from the liquidator of BCL in Botswana, and then landed an acquisition deal of the KX36 discovery from Sekaka Diamonds (a subsidiary of Petra Diamonds) which contains substantial quantities of diamonds.

LUCAPA Reveals Highest Diamond Count & Weight from Lulo Kimberlite Samples

Lucapa Diamond Company together with Project Lulo partners, Endiama and Rosas & Petalas, announced the recovery of diamonds from the initial processing of the Lulo kimberlite L164 bulk sample through the stand-alone, dedicated kimberlite bulk sample plant.

Petra Achieves US$61.3 Million in Second Tender for FY 2023

Petra Diamonds Ltd on Thursday said it increased its diamond sales in the second tender for the financial year, but the average price per carat fell. The diamond mining company with operations in South Africa and Tanzania said its diamond sales in its second tender that ended November was GBP61.3 million, trebling from USD21.5 million during its second tender in October 2021 of its financial year 2022 that ended June 30.

UPDATE: Auction Date Released on New Arctic Canadian Sales - Largest Fancy Vivid Yellow Gemstone Discovered in Canada

UPDATE (Nov. 24, 2022): ARCTIC CANADIAN ANNOUNCES AUCTION VIEWING DATES

Where can they come and do viewings: Arctic Canadian Diamond - Schupstraat 15

When: 08-14 December viewings and on 15 December live auction

Who should they contact for an appointment: receptionantwerp@arcticcanadian.ca

More info at: latifa.elkostit@arcticcanadian.ca