Mining Companies Reporting On Q2 Results

Mining company Burgundy Diamond Mines reports a recovery of 1.22 million carats during quarter 2 of 2024. This is a decrease by 10% in comparison with the same quarter previous year, which is in line with the decrease in the total volume of tonnes the company has processed (Q2-2023: 1.36 million). Burgundy sold 1.03 million carats and the sales happened over three sales events, including one fancy sale. The mining company achieved significant progress in several key areas this quarter.

Batswana Soon To Be Co-Owners Of Mines?

Botswana is taking steps to strengthen local ownership in its mining sector by introducing new legislative measures. The draft law requires that citizens acquire a 24% stake in mining operations, reflecting the government's commitment to ensuring that the benefits of the country's rich mineral resources are shared more equitably among its population.

De Beers Sells Iron Ore Royalty For $150 Million

Anglo American said on Monday it has agreed to sell two royalty assets to Taurus Funds Management for up to $195 million. One of these royalty assets is De Beers' royalty interest in the Onslow Iron Project in Australia. Taurus will buy this unit for $150 million.

De Beers' CEO Al Cook refers to the announcement of their Origin Strategy on 31 May and says that with this sale, they are taking another step in delivering their promise to streamline De Beers. "This means that we can focus our people, our resources and our capital on what we do best: diamonds", according to Al Cook.

Petra Diamonds Sees Sales Volume Rise

Petra Diamonds’ sales rose 13% for the full fiscal year, Sales volume grew 36% to 3.2 million carats.

The company attributes a portion of the rise to the completion of a ramp-up to steady processing at its Williamson mine. Petra also had extra rough during the period it had held back from sales at the end of the previous year when prices were low due to lackluster rough demand.

Picture Credit: Petra Diamonds

De Beers Considering Production Reduction

De Beers is considering reducing its diamond production. The main reason is deteriorating market conditions resulting from weak consumer demand in China.

“With higher-than-normal levels of inventory remaining in the midstream and an expectation for a protracted recovery, we are actively assessing options with our partners to further reduce production to manage our working capital and preserve cash,” the company said Thursday.

South Africa's Diamond Production at 10 year-low

The diamond production in South Africa is at a 10-year low. Where the country used to produce an average of 8.5 million carats a year (before 2023), the production has now dropped to 6.1 million carats in 2023.

The drop has been caused by the temporary halt of production at De Beers' Venetia diamond mine, which accounted for 40% of the country's diamond production.

De Beers is developing Venetia as an underground mine to extend its operational life until the 2040s. The company expects to extract 88 million carats from this new phase.

Temporary inactivation drops Rio Tinto's production

In January of this year, a plane crashed in Canada, with several workers from Rio Tinto's Diavik mine on board. The mining company subsequently decided to temporarily pause operations at the mine to give its workers sufficient time and space to process this tragic accident. This temporary halt in operations caused diamond production to drop 28% in the second quarter compared to the same period last year.

Lucapa Resumes Exploration in Angola

The wet season in Angola - which was very severe this year and caused heavy flooding - has ended. Now that the water has receded and most areas are accessible again, Lucapa Diamond Company is resuming its exploration activities. The focus is on the Kimberlite L014 area, the area beneath the Cacuilo-rivier, as this area is more likely to be the major source of the diamonds being found in the river’s alluvial deposits. The road to access the L014 area has begun, along with auger drilling to better define the location of the best material for sampling.

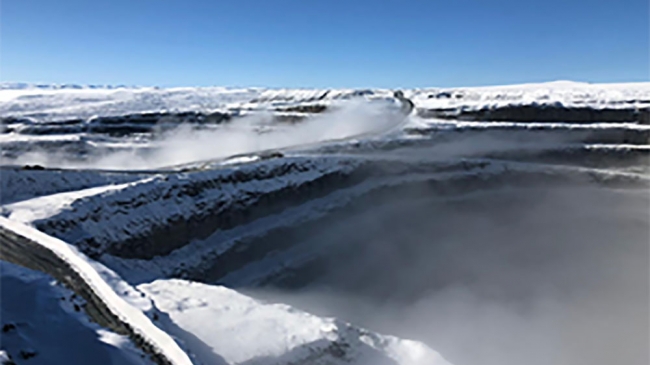

Burgundy Eyes Misery Mine Life Extension

Australian miner Burgundy Diamond Mines, operating the Ekati mine in Canada's Northwest Territories is looking at the potential to extend the Misery underground mine's life beyond the anticipated 2025 end of life date. Extension drilling is ongoing to assess whether the main ore body is deeper and wider than originally assumed. Updated resource estimates are expected to be announced later this year, with an updated mine plan.

Photo credit: Burgundy Diamond Mines

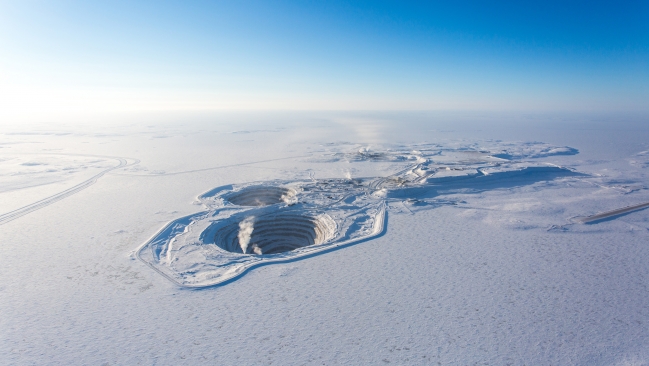

Russia Jumped Over Botswana as Largest Producer in Value in 2023

According to recently released Kimberley Process statistics, in 2023, Russia became the largest producer of rough diamonds in terms of value, jumping over Botswana, despite sanctions on Russian diamonds by the G7. Total value of Russian rough production amounted to US$3.61bn, for a volume of 37.3m ct, compared to Botswana's total production value of US$3.28bn, for a total of 25.1m ct.

Photo credit: Envato Elements

Alrosa Buys Gold Mine

Russian diamond mining company Alrosa, through its Almazy Anabara subsidiairy has purchased the Degdekan gold mine from Polyus for US$276m. Commencing production in 2028, at full capacity, the mine is expected to produce around 3.3 tonnes of gold annually, with an estimated life span that runs through to 2046, estimated at 100 tonnes. Both Alrosa and Polyus are subject to Western sanctions.

Photo credit: Envato Elements

Lucapa Mothae (Lesotho) Mine Sale Takes Shape

Lucapa announces a conditional Sale and Purchase agreement has been reached with Lephema Executive Transport Ltd, having provided long-term mining services to the mine, for its 70% stake in the Mothae mine in Lesotho. Mid May, Lucapa announced its plans to divest the Lesotho operation in favor of focusing on the miner's assets in Australia and Angola.

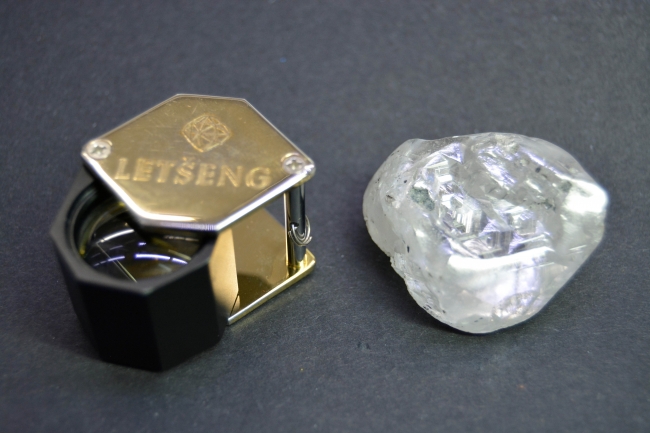

Gem Diamonds Recovers 172.06ct Type II Diamond

Gem Diamonds has announced the recovery of an exceptional 172.06ct Type II white rough diamond, the seventh 100+ct diamond recovered at its Letšeng mine this year alone.

Mission Masisi at JCK Las Vegas: Safeguarding the Future of Botswana

In a surprising move, Botswana President Masisi yesterday left the country to join industry stakeholders at the 2024 JCK Las Vegas show. Botswana finds itself in the middle of a perfect storm of challenges: De Beers' parent company Anglo American recently became the target of potential take-over bids, which led to Anglo announcing plans to spin off its diamond business.

Letšeng mine in Lesotho delivers 212.49ct Type II White Diamond

Gem Diamonds Limited, the company that owns 70% of the Letseng mine in Lesoto, announced today the discovery of a 212.49ct Type II White Diamond. This remarkable stone was brought to the surface on May 28 and it is the sixth diamond weighing more than 100 carats to be unearthed this year from that mine.

Rare 195 Carat Type IIa Diamond Discovered At Lulo Alluvial Mine In Angola

Lucapa Diamond Company announced yesterday the recovery of a 195 carat diamond, discovered in the Lulo Alluvial Mine in Angola. It involves a type IIa diamond, which occurs only very rarely in nature. Special about this type of diamonds is the fact that they have no measurable nitrogen or boron impurities, making them the most chemically pure diamonds with the highest thermal conductivity that exists. Mostly these diamonds are colorless, but they can also be gray, light brown, light yellow or light pink.

Petra Diamonds Goes Green

Petra Diamonds, the diamond mining company with mines in South Africa and Tanzania, has signed a long-term power purchasing agreement with Etana Energy, South African energy supplier, to provide its South African operations at Cullinan and Finsch with renewable energy from Etana's existing and future wind and solar projects. Etana will supply between 36% and 72% of the estimated energy requirements starting from financial year 2026 onward, aimed at reducing Petra's GHG emissions well ahead of the 2030 target.

4th De Beers Sales Cycle Drops 21% y-o-y

De Beers 4th sight cycle revenues totaled US$380m, a 21% drop from US$479m achieved in the 4th cycle of 2023 and -15% from sight n°3 this year, translating in a 17% decrease in revenues from sales (US$ 1.63bn this year vs US$1.97bn in 2023) year-to-date. The lower sales figures correspond with current market sentiment and add to the turbulence surrounding a potential sale of the diamond entity of Anglo American.

Photo credit: Anglo American Plc

Lucapa To Sell Lesotho Mothae Mine

Lucapa, the Australian listed miner with operations in Angola (Lulo) and Lesotho (Mothae) is looking to divest its 70% stake in the Mothae mine after a review of its asset portfolio by the recently restructured Lucapa board of directors.

Lucara Reports Robust Q1 Results

Lucara Diamond in its Q1 2024 release reports total revenues of US$41.1m, slightly down y-o-y from US$42.8m. A total of 93,560ct were sold through its different sales channels, including through the renewed 10-year sales agreement with HB for specials (10.8ct+ rough diamonds) produced, with so-called "top-up payments" resulting in US$4.9m of the total revenues. In total 160 "specials" (5.1% of total cts) were recoverd in Q1, 3 of which larger than 100ct and one larger than 300ct.

Alrosa Stake Catoca (Angola) For Sale

According to Interfax, quoting Russia's Ministry of Finance Moiseyev, Alrosa will have to sell its stake in Angola's Catoca operation, as pressure from the West on the Angolans mounts to cut ties with Russian, sanctioned entities. According to Moiseyev negotiations to take over Alrosa's share, which originally stood at 41% of the mining operation, are ongoing with "friendly investors".

Burgundy Starts Strong in Q1

Burgundy Diamond Mines, reports strong results for Q1 2024 despite a subdued rough and polished market, with record revenues of US$117m for 1.32m cts sold (+65% in volume y-o-y). CEO Kim Truter cites Burgundy's consistent diamond quality and provenance assurances as key drivers for strong buyer interest. In Q1, Burgundy recovered 1.15m carats, including a 23.15ct fancy intense yellow.

Photo credit Burgundy Diamond Mines

Anglo American: Game of Bids Begins

The Financial Times reports on the developing story of the unsolicited bid of Australia-listed BHP on London-listed mining conglomerate Anglo American, which includes the diamond mining branch De Beers, naming potential suitors. BHP's bid was rejected earlier this week by Anglo's board but says it is safe to assume BHP might counter with an improved proposal, while other candidates may well offer a competing bid.

Lucapa Q1 Results Down, Q2 Starts Promising

Lucapa, operating the Lulo mine in Angola and Mothae in Lesotho, reports Q1 results were down with revenues clocking at US$13.1m, down 28% y-o-y, and rough prices down 41%, from avg 1,350US$/ct to 798US$/ct. Lulo production focused on lower grade areas due to flooding, resulting in low grades in carats recovered, while Mothae production improved in terms of carats recovered but with a significantly lower frequency of exceptional, high value diamonds.

Namdia to Invest 3.4bnUS$ in Local Diamond Industry

Namibian Mining News reports that at Mining Indaba, Namdia has unveiled plans to invest a massive 3.4bn US$ over the next ten years, expanding its operations, including through social responsiblity actions in its "Equitable Economic Empowerment Framework" and renewing its focus on exploration, aligned with more accessible and up to date exploration licenses and mining rights information via an e-platform. Namibia, ramping up its activities in green energy rapidly, is a mineral-rich country with huge potential in critical minerals such as lithium and rare earths.

Petra Sells 50 Percent of Williamson Mine Stake for $15M

Petra Diamonds announced last week that Taifa Mining and Civils Limited, will be buying 50 per cent less one share of the Petra’s shareholding in Williamson Diamonds Limited (WDL). Tiafa Mining has been serving as the long-term technical services contractor at the Williamson Mine for over 20 years in coordination with Petra but have now stepped up their role as an equity stakeholder in the project.

Diamcor Begins Bulk Sampling into Greater Areas of its Krone-Endora at Venetia Diamond Mine Project

Canadian mining company Diamcor announced that it will be proceeding with an extensive drilling and bulk sampling program over the greater portions of its Krone-Endora at Venetia diamond mine project.

108 Carat Fancy Intense Pink Diamond Discovered in Lesotho at SMD Kao Mine

Storm Mountain Diamonds announced yesterday the recovery of a rare fancy intense pink diamond weighing 108.39ct at its Kao mine in the Kingdom of Lesotho. The stone was discovered earlier this year on March 23rd, 2023.The exceptionally rare Type IIa gemstone is one of the largest pink diamonds in history to have been recovered.

Mountain Province Diamonds Optimistic about Kelvin and Faraday Kimberlite Studies: Over 18 million Carats Present

Mountain Province Diamonds, a 49% participant with De Beers Canada in the Gahcho Kué diamond mine located in Canada's Northwest Territories made their Q1 Reports for the spring season of 2023.

GEM Diamonds Remain Optimistic for 2023 Despite Share Prices Declining to Lowest Point Over Last Year

Clifford Elphick, CEO of GEM Diamonds said in an announcement on Thursday (March 16) that market volatility caused by the invasion of Ukraine by Russia contributed to a decline in diamond prices. GEM achieved an average selling price of $1,755 per carat compared to $1,835 per carat in 2021. Though he remains overall optimistic regarding the mine’s capacity to rebound during the 2023 fiscal year.

They reported a 31% decline in attributable profit for the 12 months ended December 12 of $10.2m compared to $14.8m in the previous financial year.

Snap Lake Mine Enters Final Stages of Closure

De Beers’ Snap Lake diamond mine, Canada's first fully underground mine located in the Northwest Territory, is “entering the final stages of active closure” ahead of a switch to long-term monitoring. This will represent the final stages of shut down since it was decided by the company to cease operations in 2015.

Debswana and Huawei Unveil the World’s First 5G Mine

Debswana and Chinese tech giant Huawei at the Mobile World Congress Trade Show this week announced plans for the unveiling of "the world's first 5G-oriented smart diamond mine project".

The 5G network allows cutting-edge technologies like autonomous driving and enables more intelligent digital transformation of the mining industry in the years to come.

Homestead Diamonds Recovers Type-IIa 13-carat Pink Diamond at Samanda Mine (South Africa)

Homestead Diamonds has recovered a rare 13-carat pink diamond from its bulk sampling operation on the Samada kimberlite pipe in the Free state province of South Africa. The 13.33-carat Pink is a Type IIa diamond and is one of several exceptional fancy colour stones recovered since the commencement of the bulk sampling programme in 2020.

Rio Tinto Invests $40 Million into Underground Mining Operation at Diavik

Rio Tinto has made $40 million investment in the first phase of underground mining below the existing A21 open pit at its Diavik Diamond Mine which started commercial production in 2018 in the Northwest Territories of Canada. The Diavik mine, Canada’s largest mine produces on the order of 6.5 million carats (+/-) of rough diamonds per year and has unearthed more than 100 million carats since its opening.

Lucara Underground Mine Expansion Progresses at Karowe Mine with Anticipated Full Production by 2026

Lucara Diamond has published an updated report on the progress of its underground expansion project at Karowe diamond mine in Botswana.

The expansion will extend the life of the mine to at least 2040 and contribute $4 billion in additional revenues. Mine ramp up is expected in 2026 with full production from underground to be reached in the second half of that year.

Arctic Canadian, Taché & Samir Gems Work Responsibly with Largest Fancy Vivid Yellow Diamond Ever Discovered in Canada Making History in the Process

[A DIAMOND LOUPE EXCLUSIVE STORY] - It was only just last September that Canadian mining company Arctic Canadian (AC) announced the recovery of a yellow diamond weighing an impressive 71.26 carats. The rough octahedron gem is currently the largest known fancy vivid yellow diamond ever discovered in Canada.

Petra Diamonds Solicits M&A Proposals: Open to “Consider Consolidation”

According to Reuters, Petra Diamonds invited merger and acquisition proposals on Monday, with CEO Richard Duffy saying the industry would benefit from consolidation.

"We have got opportunities to grow organically but given that we are through this restructuring and we have a much more robust balance sheet, we would be willing to consider consolidation if it makes value sense," Duffy told Reuters in an interview on the sidelines of the Investing in African Mining Indaba in Cape Town.

Mountain Province Produced 5.52 million Carats in 2022

Mountain Province Diamonds has announced production and sales results for Q4 and 2022 from the Gahcho Kué Diamond Mine.

According to Rough & Polished, during Q4, 1,621,800 carats were recovered. For the full year 2022, 5.52 million carats were recovered (less than the guidance of 5.60 – 5.80 million carats). In 2022, approximately 2.7 million carats were sold at an average value of $112 per carat for total proceeds of $297.3 million. This compared to 3.2 million carats sold at an average value of US $75 per carat for total proceeds of US$236.9 million in FY 2021.

Rio Tinto Lowers Diavik’s 2023 Production Forecast to 3-3.8 Million Carats

Rio Tinto, which owns 100% of the Diavik Diamond Mine in the Northwest Territories in Canada, has lowered Diavik’s 2023 production forecast – from 4.5 to 5 million carats to 3 to 3.8 million carats.

According to IDEX Online, Rio Tinto “gave no explanation for the lower forecast in its fourth quarter production results.” In 2022, actual production was on target – 4.7 million carats.

The Diavik diamond mine opened in 2003 and is scheduled to close in 2025.

Source: IDEX | Israeli Diamond

Photo Credit: Rio Tinto

Tanzania Reports Record $63 Million in Diamond Exports Despite Williamson Mines Closure

The Bank of Tanzania announced that the country’s diamond exports increased significantly to $63.1 million (USD) in value by November 2022. This is more than seven times of the $8.4 million export value that was recorded in the year-over year analysis since November 2021.

Lucapa Recovers 2 Special Sized Diamonds in Recent Exploration

Lucapa Diamond Company Limited together with their Project Lulo partners, Endiama and Rosas & Petalas, have recovered a total of 41 diamonds weighing 66.05 carats in a recent kimberlite sample.

The sample also includes two special sized diamonds weighing 15.27 and 12.37 carats, with 12 diamonds greater than one carat recovered totaling of 50.21 carats.

Sarine Technologies and Delgatto Diamond Finance Fund Revolutionize Rough Diamond Financing in New Collaboration

Sarine Technologies has signed a strategic cooperation agreement with the Delgatto Diamond Finance Fund (DDFF) that will enable DDFF to “significantly” increase the amount of capital it provides to the rough sector, as well as expand the types of structures it offers enable more efficient rough diamond financing, starting from January 15th.

Blue Rock Diamonds Overcomes Production Troubles Caused by Excessive Rain in Q4-2022

BlueRock Diamonds says it has finally gotten through the last of the problems that cut its processing production by over 30% caused by unseasonable rains that flooded the country last

April and again in October through November. In an update posted by London-based miner the company confirmed it was now back to normal production levels, even during a particularly rainy fourth quarter.

Botswana Diamonds Makes Plans for Explorations in South Africa and Zimbabwe in 2023

Botswana Diamonds (BOD), the UK-based explorer, says it is seeking joint venture opportunities to seek out new assets in Zimbabwe and South Africa in the new year.

Speaking of Zimbabwe, John Teeling, chairman of BOD, said in a trading update: “There are significant geological opportunities in the country. The objective is to find a formula, which suits all parties.”

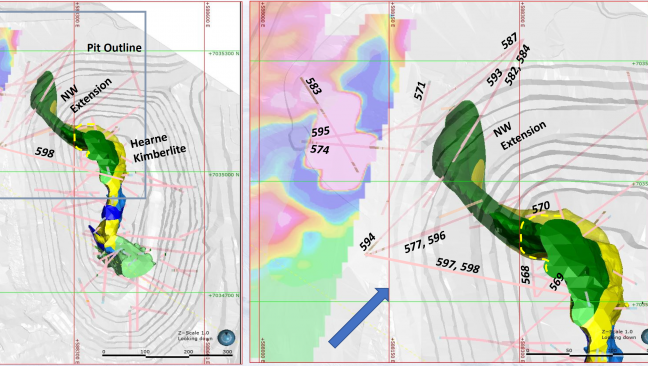

Mountain Province Diamonds Completes Phase One Drilling for the Hearne Northwest Extension Discovery at Gahcho Kué Mine

The Hearne kimberlite is one of four kimberlites being mined at Gahcho Kué Mine, which is presently ranked as 4th in the world by annual diamond production. Mountain Province is a 49% shareholder at Gahcho Kué with joint venture partner De Beers Canada as operators.

Petra Achieves US$42.3 Million in Sales in Third Tender for FY 2023

Petra announces the results of Tender 3 of FY 2023, at which 305,366 carats were sold for a total of US$42.3 million across Petra’s mining operations.

“Petra’s third tender for FY 2023 saw a 2.2% increase in like-for-like prices on Tender 2 FY 2023, reversing the downward trend observed in the previous two tenders. Although it is still too early to speculate on whether rough diamond prices have bottomed out, we are very satisfied with the overall result, “said Richard Duffy, CEO of Petra.

Zimbabwe Builds National Reserve by Asking for 50% of Diamond Miners’ Royalty Payments to be in Rough Stones

Diamond miners in Zimbabwe are now required to pay half their royalties to the government in rough stones, 40 per cent in local currency and 10 per cent in foreign currency. The annual earnings of the mining sector have nearly doubled from US$2.7 billion in 2017 to US$5.73 billion in 2021. Projections by the Ministry of Finance show that mining earnings will reach US$7.3 billion by the end of the year, achieving 60.8% of the US$12 billion target for 2023.

Botswana Diamonds Remains Optimistic for 2023

Declaring a slight -0.09% loss on the GBX in 2022, Botswana Diamonds (BD) remains optimistic regarding their latest strategy of acquiring existing lots from former mining exploitations. This year alone the company has increased its stake to 50% in the Maibwe joint venture by acquiring a stake from the liquidator of BCL in Botswana, and then landed an acquisition deal of the KX36 discovery from Sekaka Diamonds (a subsidiary of Petra Diamonds) which contains substantial quantities of diamonds.

LUCAPA Reveals Highest Diamond Count & Weight from Lulo Kimberlite Samples

Lucapa Diamond Company together with Project Lulo partners, Endiama and Rosas & Petalas, announced the recovery of diamonds from the initial processing of the Lulo kimberlite L164 bulk sample through the stand-alone, dedicated kimberlite bulk sample plant.

Firestone Restarts Operations at Linghobong Mine After 2-Year Pause

Firestone has reported the successful resumption of operations at the Liqhobong Mine after a two and-a-half-year care and maintenance period which commenced from March 2020. Firestone management remained mindful that any potential restart of activities would be required to take place at minimal cost and in the shortest possible timeframe. To achieve this, a number of work-streams were run in parallel, including, particularly, appointing a long-term mining contractor and essential staff.

Mountain Province Finds New Kimberlite Around Gahcho Kue Mine

Mountain Province Diamonds has found new kimberlite on the claims and leases surrounding the existing Gaucho Kué mining operation in the Northwest Territories. The new KE kimberlite “is a distinct occurrence that is located about 450metres east of the Kelvin kimberlite,” the Toronto-based miner said on Wednesday. Further drilling of the KE kimberlite is planned for the 2023 exploration program, Mountain Province said. The mine is slated to operate until 2028.

Gahcho Kué is a joint venture between Mountain Province holding a 49% stake and De Beers Group, which owns 51%.

Lucara Announces 10-Year Extension on HB Antwerp Sales Agreement

Lucara Diamond has concluded and extension on their diamond sales agreement with Lucara Botswana, and HB Antwerp Antwerp Trading, with the intent of selling +10.8 carat rough diamonds produced from Lucara’s Karowe mine through December 31, 2032. The general terms of the deal are as follows: Lucara’s +10.8 carat production is sold at prices based on the estimated polished outcome of each diamond, determined through state-of-the-art scanning and planning technology, with a true up paid on actual achieved polished sales thereafter, less a fee and the cost of manufacturing.

KAO Mine Breaks Personal Record with a new 47.80-carat Pink Diamond

In recent years, the Kao Mine in Lesotho has established itself as a leading producer of exceptional pink diamonds. Over the last few years, some remarkable stones have been recovered, including the Pink Storm, the Purple Princess and the Rose of Kao. The last discovery, the Pink Palesa a 21.86-carat Pink Palesa diamond, was sold in June of 2021 in Antwerp by Bonas Group.

De Beers Welcomes Al Cook as New CEO

Mid September Bruce Cleaver still attended FACETS 2022, the conference on Diamonds in The Age Of The Consumer in Antwerp, organized by the Antwerp World Dmaiamond Center (AWDC). Today he announced that he will be stepping down from his role of CEO of De Beers after 8 years of holding the post, opting for the role of co-chairman of the diamond behemoth. He joined De Beers group in 2005 and became CEO in 2016.

Angola Increases Govt Stake in Catoca

The Financial Times reports that the Angolan Government has blocked and taken over the 18% stake of the Chinese company LLI (part of Sonangol) in Catoca. The Government now holds 59% of shares in Angola’s largest mine through IGAPE, the state body managing govt shareholding in companies active in the country. The move is considered another step in President Lourenço’s reform policy, reducing the interdependence with China that was established under the Dos Santos regime, when deals between Angola and China, especially in the oil business, were booming.

DRC Ministry of Mining, AWDC, DDI@RESOLVE and Everledger Kickoff ASM Pilot in DRC

During a kickoff meeting that took place in Kananga, in the DRC’s Kasai region last week, the Antwerp World Diamond Centre (AWDC), together with the DRC’s Ministry of Mining and its subdivisions SAEMAPE and CEEC, NGO DDI@RESOLVE and tech company Everledger initiated OrigemA, a pilot project that aims to set up a fully transparent, digitally enabled mine-to-market program for Artisanal and Small-Scale Mining (ASM) cooperatives in the DRC.

Lucapa Merlin Mine Update

Australia-based Lucapa acquired the Merlin Diamond Project in the Northern Territory, Australia in 2021. The miner is currently progressing the Merlin Feasibility Study and assessing different mining methods for the kimberlite pipes including vertical pit mining (VPM), illustrated in this animation.

Petra Tender 5 FY2022 Yields US$ 86.1 million

Petra Diamonds announced the results of their Tender cycle 5 of fiscal year 2022. They sold 635,806 carats for a total of US$86.1 million. Prices decreased by 23.7% compared to Tender 4 (March 2022) but were up 3.2% on Tender 3 (December 2021).

The tender included a 13.74 ct blue Exceptional Stone for the Cullinan mine. The stone was sold into a partnership with Stargems for US$ 5.7 million, with Petra retaining a 50% interest in the profits.