Archive

- 22/04/2024 11:28

ASX-listed Lucapa Diamond Company announced that three exceptional diamonds achieved US$10.5 million at the first tender of Lulo diamonds for 2024.

- 20/04/2023 10:26

Angolan mining company Lucapa has posted their Q1 reports for this year with many positive highlights. At its Lulo operation, there has been a new record set in volumes mined, with an 11% increase in tonnage, resulting in over 591,00 tons processed, up from 533,000 tons processed at the same time last year. The mine also reported the recovery of a 150 carat Type IIa diamond and several fancy-colored stones - three diamonds, including two +100 carat diamonds, which will be held back from normal sale for a planned tender.

- 23/02/2023 10:36

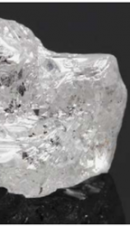

Lucapa Diamond Company Limited together with Lulo partners, Endiama and Rosas & Petalas, have announced today the recovery of a 150-carat white Type IIa diamond from the Lulo Alluvial Mine in Angola. This stone represents the the 36th +100-carat diamond recovered at Lulo. The 150 carat diamond was recovered from Mining Block 28 (“MB28”) and is the fifth +100 carat diamond recovered from that particular mining block.

- 30/01/2023 10:54

Lucapa has released the results of its fourth quarter of activity during the last year. According to a company press release, record volumes were processed last quarter, recovering four +100 carats including several fancy-colored stones valued at over $5.9 US million were set aside for a Lulo exceptional stone tender.

- 16/01/2023 12:27

Lucapa Diamond Company Limited together with their Project Lulo partners, Endiama and Rosas & Petalas, have recovered a total of 41 diamonds weighing 66.05 carats in a recent kimberlite sample.

The sample also includes two special sized diamonds weighing 15.27 and 12.37 carats, with 12 diamonds greater than one carat recovered totaling of 50.21 carats.

- 08/12/2022 12:02

Lucapa Diamond Company together with Project Lulo partners, Endiama and Rosas & Petalas, announced the recovery of diamonds from the initial processing of the Lulo kimberlite L164 bulk sample through the stand-alone, dedicated kimberlite bulk sample plant.

- 16/11/2022 15:50

Lucapa Diamond Company Limited has announced earlier this week that seven exceptional diamonds achieved USD $20.4 million on international diamond tender. The international diamond tender was conducted by SODIAM E.P. in Luanda, Angola and featured seven special sized diamonds weighing 767 carats. The diamonds were recovered by SML from the Lulo alluvial mine. Most notably, “The Lulo Rose”, a 170-carat fancy coloured diamond was among the stones up for tender, along with three +100 carat white Type IIa diamonds and three other special sized white Type IIa stones.

- 27/07/2022 10:25

Australian miner Lucapa discovered a massive 170ct pink diamond at its Angolan Lulo mine, believed to be the largest pink recovered in the past 300 years. The incredibly rare find is named "The Lulo Rose".

- 03/06/2022 10:34

Australia-based Lucapa acquired the Merlin Diamond Project in the Northern Territory, Australia in 2021. The miner is currently progressing the Merlin Feasibility Study and assessing different mining methods for the kimberlite pipes including vertical pit mining (VPM), illustrated in this animation.

- 01/03/2022 14:14

Mining company Lucapa reported a record full-year 2021 total revenue of US$98 million or an average of US$1,564/carat. The miner also announced record operational performances from both Lulo (SML), the company’s 40% held alluvial diamond mining operation in Angola, and Mothae in Lesotho, the latter sold via Antwerp. Both operations processed record volumes, recovered and sold record carats, and made some exceptional diamond recoveries. In addition, Lulo’s exploration sampling includes the discovery of 13 diamonds from the Canguige catchment area, including eight Type IIa diamonds.