Petra Diamonds Soars with $8.2m Blue Diamond Sale

Petra Diamonds recently made headlines with the sale of an exceptional US$8.2 million blue diamond, propelling its fifth tender of FY 2024 to new heights. Despite selling fewer carats, Petra achieved higher prices, with an average of US$136 per carat on sales of 362,000 carats, totaling US$49 million.

Gem Diamonds Q1 Reports and Recoveries

Gem Diamonds, who owns 70% of the Letšeng mine in Lesotho, has released its Q1 2024 Trading Update, which showcases robust operational and sales performances from January 1st to March 31st, 2024.

Key Highlights from Q1:

De Beers' Fate Uncertain as BHP Considers Anglo American Takeover

According to Reuters, Australian mining giant BHP is contemplating a potential takeover of London-listed Anglo American, parent company of De Beers, news that is confirmed by Anglo American in a statement saying the bid is being reviewed.

3 Diamonds Fetch $10.5 Million at Lucapa Tender

ASX-listed Lucapa Diamond Company announced that three exceptional diamonds achieved US$10.5 million at the first tender of Lulo diamonds for 2024.

Namdia to Invest 3.4bnUS$ in Local Diamond Industry

Namibian Mining News reports that at Mining Indaba, Namdia has unveiled plans to invest a massive 3.4bn US$ over the next ten years, expanding its operations, including through social responsiblity actions in its "Equitable Economic Empowerment Framework" and renewing its focus on exploration, aligned with more accessible and up to date exploration licenses and mining rights information via an e-platform. Namibia, ramping up its activities in green energy rapidly, is a mineral-rich country with huge potential in critical minerals such as lithium and rare earths.

Diamcor Begins Bulk Sampling into Greater Areas of its Krone-Endora at Venetia Diamond Mine Project

Canadian mining company Diamcor announced that it will be proceeding with an extensive drilling and bulk sampling program over the greater portions of its Krone-Endora at Venetia diamond mine project.

108 Carat Fancy Intense Pink Diamond Discovered in Lesotho at SMD Kao Mine

Storm Mountain Diamonds announced yesterday the recovery of a rare fancy intense pink diamond weighing 108.39ct at its Kao mine in the Kingdom of Lesotho. The stone was discovered earlier this year on March 23rd, 2023.The exceptionally rare Type IIa gemstone is one of the largest pink diamonds in history to have been recovered.

Mountain Province Diamonds Optimistic about Kelvin and Faraday Kimberlite Studies: Over 18 million Carats Present

Mountain Province Diamonds, a 49% participant with De Beers Canada in the Gahcho Kué diamond mine located in Canada's Northwest Territories made their Q1 Reports for the spring season of 2023.

Lucapa Reports Record Numbers Once Again During Q1-2023

Angolan mining company Lucapa has posted their Q1 reports for this year with many positive highlights. At its Lulo operation, there has been a new record set in volumes mined, with an 11% increase in tonnage, resulting in over 591,00 tons processed, up from 533,000 tons processed at the same time last year. The mine also reported the recovery of a 150 carat Type IIa diamond and several fancy-colored stones - three diamonds, including two +100 carat diamonds, which will be held back from normal sale for a planned tender.

NAMDIA Establishes Formal Relations with Angolan State-Owned Companies ENDIAMA and SODIAM

The CEO of Namibia Desert Diamonds (NAMDIA) expressed interest to work with the Angolan diamond companies after a recent visit from the Angolan Minister of Mineral Resources, Petroleum and Gas, Dr Diamantino Pedro Azevedo, at the NAMDIA Headquarters. Their talks highlighted the potential Namibia and Angola has in promoting the region’s diamonds to generate even greater value for Namibia and Angola, both of which are alluvial-producing countries.

GEM Diamonds Remain Optimistic for 2023 Despite Share Prices Declining to Lowest Point Over Last Year

Clifford Elphick, CEO of GEM Diamonds said in an announcement on Thursday (March 16) that market volatility caused by the invasion of Ukraine by Russia contributed to a decline in diamond prices. GEM achieved an average selling price of $1,755 per carat compared to $1,835 per carat in 2021. Though he remains overall optimistic regarding the mine’s capacity to rebound during the 2023 fiscal year.

They reported a 31% decline in attributable profit for the 12 months ended December 12 of $10.2m compared to $14.8m in the previous financial year.

Petra Achieves $72.1 million in Sales in Fourth tender Cycle for FY 2023

Petra announces the results of Tender 4 of FY 2023, at which 505,398 carats were sold for a total of US$72.1 million from Petra’s South African operations.

This cycle includes a US$7 million Exceptional Stone2 from the Cullinan Mine and US$4.3 million of Finsch diamonds sold during H1 FY 2023, both of which were reported in our Interim Results announcement during February 2023. No sales for Williamson were recorded in this cycle given the operations at the mine are still suspended.

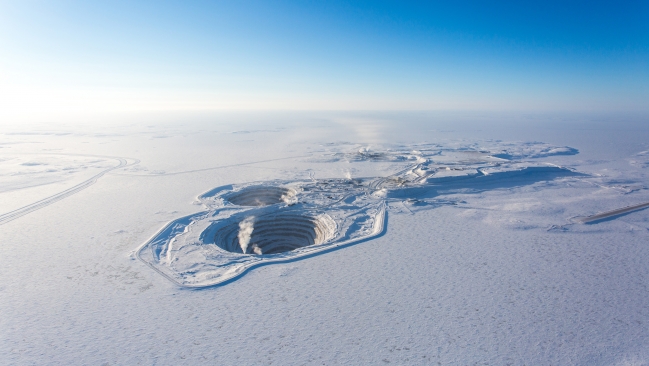

Burgundy Diamonds Acquires 100% of Artic Canadian’s Assets Including Ekati Mine

Australia-based Burgundy Diamond Mines has signed a binding share purchase agreement to acquire Canada-based Artic Canadian’s (AC) assets, including the entirety of Ekati Diamond mine, for nearly $136m. AC owns 100% of all businesses, assets and other interests comprising the producing Ekati mine in Canada’s Northwest Territories and expects the sale to result in a significant recapitalization of the firm and allow for continued operations for the Ekati Diamond Mine, which has been in production for nearly 25 years.

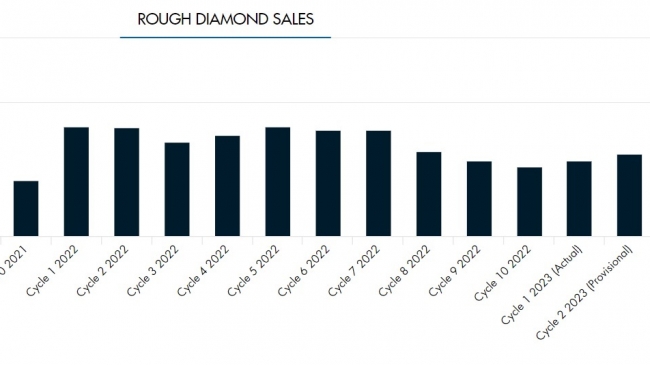

DeBeers Posts $495 Million Earnings Rough Diamond Sales in Cycle 2 - 2023

De Beers Group yesterday announced the value of rough diamond sales for the second sales cycle of 2023. The mining giant sold $495 million in rough stones. There was a noticeable year-over-year drop in sales when compared with 2022- Cycle 2, where the company sold over $652 million, a 24% fall. Sales were 9% higher than $454 million registered for the preceding first Sight of 2023.

Homestead Diamonds Recovers Type-IIa 13-carat Pink Diamond at Samanda Mine (South Africa)

Homestead Diamonds has recovered a rare 13-carat pink diamond from its bulk sampling operation on the Samada kimberlite pipe in the Free state province of South Africa. The 13.33-carat Pink is a Type IIa diamond and is one of several exceptional fancy colour stones recovered since the commencement of the bulk sampling programme in 2020.

Rio Tinto Invests $40 Million into Underground Mining Operation at Diavik

Rio Tinto has made $40 million investment in the first phase of underground mining below the existing A21 open pit at its Diavik Diamond Mine which started commercial production in 2018 in the Northwest Territories of Canada. The Diavik mine, Canada’s largest mine produces on the order of 6.5 million carats (+/-) of rough diamonds per year and has unearthed more than 100 million carats since its opening.

Lucara Underground Mine Expansion Progresses at Karowe Mine with Anticipated Full Production by 2026

Lucara Diamond has published an updated report on the progress of its underground expansion project at Karowe diamond mine in Botswana.

The expansion will extend the life of the mine to at least 2040 and contribute $4 billion in additional revenues. Mine ramp up is expected in 2026 with full production from underground to be reached in the second half of that year.

150 Carat Diamond Recovered by Lucapa in Angola

Lucapa Diamond Company Limited together with Lulo partners, Endiama and Rosas & Petalas, have announced today the recovery of a 150-carat white Type IIa diamond from the Lulo Alluvial Mine in Angola. This stone represents the the 36th +100-carat diamond recovered at Lulo. The 150 carat diamond was recovered from Mining Block 28 (“MB28”) and is the fifth +100 carat diamond recovered from that particular mining block.

Petra Posts Interim results for the 6-Months Ending 31 Dec 2022

(PETRA PRESS RELEASE): Petra Diamonds Limited announces its unaudited interim results for the six months ended 31 December 2022.

Richard Duffy, Chief Executive Officer at Petra Diamonds commented:

Arctic Canadian, Taché & Samir Gems Work Responsibly with Largest Fancy Vivid Yellow Diamond Ever Discovered in Canada Making History in the Process

[A DIAMOND LOUPE EXCLUSIVE STORY] - It was only just last September that Canadian mining company Arctic Canadian (AC) announced the recovery of a yellow diamond weighing an impressive 71.26 carats. The rough octahedron gem is currently the largest known fancy vivid yellow diamond ever discovered in Canada.

De Beers Reports Increased Diamond Production in Botswana & Namibia Despite Dip in Polished Demand

Rough diamond production increased by 6% to 8.2 million carats, reflecting strong operational performance across the assets, partially offset by the planned completion of the final cut at Venetia open pit.

Debswana Sets Record with Sales of Rough Stones During 2022

Rough diamond sales by Debswana Diamond Company reached record levels in 2022 jumping up by 22% from the previous year. The jump in sales has resulted from the West’s shunning of Russian stones whereby Botswana profited from steady global demand for diamond jewellery.

Lucapa Releases Q4-2022 Results Featuring New Growth and Recovery of Special Sized Diamonds

Lucapa has released the results of its fourth quarter of activity during the last year. According to a company press release, record volumes were processed last quarter, recovering four +100 carats including several fancy-colored stones valued at over $5.9 US million were set aside for a Lulo exceptional stone tender.

Antwerp Based Signum Initiates New Business Model of Selling Rough Stones and NFT’s B2C

Belgium based company Signum who was known for pioneering on the NFT side of the diamond trade developing a blockchain style ledger to prove diamond authenticity, now intends on incorporating the sale of rough stones directly to the public along with its digital companion into their business model.

“We are aiming to create a new product and a new market,” Rafael Papismedov, co-founder and managing partner of Signum.

Tanzania Reports Record $63 Million in Diamond Exports Despite Williamson Mines Closure

The Bank of Tanzania announced that the country’s diamond exports increased significantly to $63.1 million (USD) in value by November 2022. This is more than seven times of the $8.4 million export value that was recorded in the year-over year analysis since November 2021.

Lucapa Recovers 2 Special Sized Diamonds in Recent Exploration

Lucapa Diamond Company Limited together with their Project Lulo partners, Endiama and Rosas & Petalas, have recovered a total of 41 diamonds weighing 66.05 carats in a recent kimberlite sample.

The sample also includes two special sized diamonds weighing 15.27 and 12.37 carats, with 12 diamonds greater than one carat recovered totaling of 50.21 carats.

Sarine Technologies and Delgatto Diamond Finance Fund Revolutionize Rough Diamond Financing in New Collaboration

Sarine Technologies has signed a strategic cooperation agreement with the Delgatto Diamond Finance Fund (DDFF) that will enable DDFF to “significantly” increase the amount of capital it provides to the rough sector, as well as expand the types of structures it offers enable more efficient rough diamond financing, starting from January 15th.

Blue Rock Diamonds Overcomes Production Troubles Caused by Excessive Rain in Q4-2022

BlueRock Diamonds says it has finally gotten through the last of the problems that cut its processing production by over 30% caused by unseasonable rains that flooded the country last

April and again in October through November. In an update posted by London-based miner the company confirmed it was now back to normal production levels, even during a particularly rainy fourth quarter.

DeBeers’ Auction Sales Soar at the End of 2022

Global diamond group DeBeers has reported an over 20% bump in auction sales towards the closing of the 2022 sales year during its 10th and final yearly sales cycle. The mining and trading firm sold £340million of the gems at its auction in December – up from £279million in December 2021.

Before the pandemic, diamond prices were falling as the market struggled with oversupply, economic slowdown in China, and a global squeeze on luxury goods spending. The estimated sales at the December auction were down 10 per cent on the November auction, where the firm made £377million.

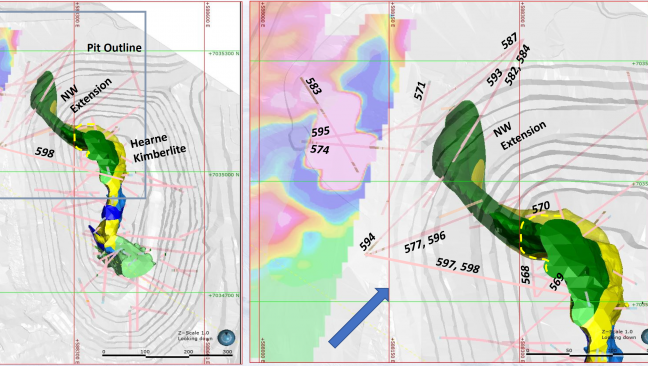

Mountain Province Diamonds Completes Phase One Drilling for the Hearne Northwest Extension Discovery at Gahcho Kué Mine

The Hearne kimberlite is one of four kimberlites being mined at Gahcho Kué Mine, which is presently ranked as 4th in the world by annual diamond production. Mountain Province is a 49% shareholder at Gahcho Kué with joint venture partner De Beers Canada as operators.

Golden Canary Breaks Records As 3rd Most Valuable Diamond Ever Sold at Auction

Sotheby’s got $12.4 million for the 303.1 ct. Golden Canary—the recut version of the Incomparable—making it the third most valuable yellow diamond ever sold at auction. The Golden Canary is a Fancy Deep Brownish Yellow color and is considered the largest internally flawless diamond in the world.

The story of the Golden Canary’s discovery is also quite captivating.

DeBeers Strikes Out on Exceptional Blue Collection Sales at Latest Auction – May Indicate Drop in Demand for Blue Stones

De Beers had two more strikeouts with its Exceptional Blue Collection recovered in Petra’s South African Cullinan mine, this last Dec. 7 - perhaps a harbinger of waning demand in the colored diamond auction market.

Rough Diamond Prices Expected to Hold in FY2024

Rough diamond prices are likely to remain firm in FY2024 as no major ramp-up in mining output (of rough diamonds) is expected over the next two years. This, coupled with recessionary pressures, shall continue to exert pressure on the revenues and profit margins of Indian cut and polished diamond (CPD) entities in FY2024, according to credit rating agency ICRA.

Botswana Diamonds Remains Optimistic for 2023

Declaring a slight -0.09% loss on the GBX in 2022, Botswana Diamonds (BD) remains optimistic regarding their latest strategy of acquiring existing lots from former mining exploitations. This year alone the company has increased its stake to 50% in the Maibwe joint venture by acquiring a stake from the liquidator of BCL in Botswana, and then landed an acquisition deal of the KX36 discovery from Sekaka Diamonds (a subsidiary of Petra Diamonds) which contains substantial quantities of diamonds.

LUCAPA Reveals Highest Diamond Count & Weight from Lulo Kimberlite Samples

Lucapa Diamond Company together with Project Lulo partners, Endiama and Rosas & Petalas, announced the recovery of diamonds from the initial processing of the Lulo kimberlite L164 bulk sample through the stand-alone, dedicated kimberlite bulk sample plant.

Petra Achieves US$61.3 Million in Second Tender for FY 2023

Petra Diamonds Ltd on Thursday said it increased its diamond sales in the second tender for the financial year, but the average price per carat fell. The diamond mining company with operations in South Africa and Tanzania said its diamond sales in its second tender that ended November was GBP61.3 million, trebling from USD21.5 million during its second tender in October 2021 of its financial year 2022 that ended June 30.

UPDATE: Auction Date Released on New Arctic Canadian Sales - Largest Fancy Vivid Yellow Gemstone Discovered in Canada

UPDATE (Nov. 24, 2022): ARCTIC CANADIAN ANNOUNCES AUCTION VIEWING DATES

Where can they come and do viewings: Arctic Canadian Diamond - Schupstraat 15

When: 08-14 December viewings and on 15 December live auction

Who should they contact for an appointment: receptionantwerp@arcticcanadian.ca

More info at: latifa.elkostit@arcticcanadian.ca

Lucara Announces 10-Year Extension on HB Antwerp Sales Agreement

Lucara Diamond has concluded and extension on their diamond sales agreement with Lucara Botswana, and HB Antwerp Antwerp Trading, with the intent of selling +10.8 carat rough diamonds produced from Lucara’s Karowe mine through December 31, 2032. The general terms of the deal are as follows: Lucara’s +10.8 carat production is sold at prices based on the estimated polished outcome of each diamond, determined through state-of-the-art scanning and planning technology, with a true up paid on actual achieved polished sales thereafter, less a fee and the cost of manufacturing.

7 Exceptional Diamonds Earn Over $20 million at Luanda Tender

Lucapa Diamond Company Limited has announced earlier this week that seven exceptional diamonds achieved USD $20.4 million on international diamond tender. The international diamond tender was conducted by SODIAM E.P. in Luanda, Angola and featured seven special sized diamonds weighing 767 carats. The diamonds were recovered by SML from the Lulo alluvial mine. Most notably, “The Lulo Rose”, a 170-carat fancy coloured diamond was among the stones up for tender, along with three +100 carat white Type IIa diamonds and three other special sized white Type IIa stones.

Lucapa Finds Massive 170ct Pink at Lulo Mine

Australian miner Lucapa discovered a massive 170ct pink diamond at its Angolan Lulo mine, believed to be the largest pink recovered in the past 300 years. The incredibly rare find is named "The Lulo Rose".

Botswana President Masisi Visits Antwerp Diamond Industry

On Tuesday, President Masisi of Botswana, the First Lady, and a large delegation including the country's Minister of Minerals and Energy Moagi and Minister of International Affairs and Cooperation Kwape visited the Antwerp diamond community.

Antwerp Industry Body AWDC Appoints David Gotlib as New President

The Antwerp World Diamond Centre (AWDC), the industry organization representing Antwerp’s 1600 diamond companies and service providers, has appointed David Gotlib as its new President, replacing outgoing President Chaim Pluczenik. The Board also appointed Sahag Arslanian and Amish Jain as Vice Presidents.

First Newfield Resources Tongo (SL) Sale in Antwerp Exceeds Expectations

Australia-based Newfield Resources, concluded its maiden sale of 5333ct rough produced in the miner’s Sierra Leone Tongo mine, via Antwerp tender specialist Bonas Group successfully, with total revenues amounting to US$1.44m. Strong demand pushed prices for the 15 trial sale lots to an average of US$269/ct, well over Newfields estimation of US$222/ct. Newfield will conduct more sales this year as the company starts production at two of the five identified kimberlites on the Tongo mining leases.

Zimbabwe Independent Claims 20m$ in Diamond Revenues Disappeared through Shady Deal

According to the Zimbabwe Independent, they have obtained evidence that over US$ 20m of diamond revenues was siphoned out of the country as the state-controlled diamond sales agency fails to handle continued corruption and malpractices. In its most recent tender, the four parcels on the block were won by two companies, Diamore DMCC (3 parcels) and NRTS Diamonds Ltd (1 parcel).

First Element Reports Successful Jagersfontein and Rooipoort Sale in Antwerp

First Element reports extremely strong results from their Antwerp sale of Jagersfontein Developments and Rooipoort Developments production which closed on Monday (23rd May) at the Antwerp Tender Facility. 100% of the parcels on offer were sold with increases in prices seen across all categories, especially in the smaller goods. There were 112 companies who placed bids with 62 of them being successful. “It appears that the diamond market has recovered exceptionally well after the uncertainty seen in recent weeks.

Botswana Wants More Out of De Beers Deal, modeled after Lucara - HB Antwerp

Africa Intelligence reports that Botswana’s President Masisi, speaking at a gala dinner hosted by Lucara Diamonds, is adding pressure to the negotiations with De Beers on a renewed Debswana contract, the 50/50 joint venture between the government and De Beers. In the current agreement, 75 % of Debswana’s rough is sold via De Beers, 25% is sold via the state-owned Okavango Diamond Company, the latter achieving record sales revenue via its sales in Antwerp last year.

Namdia Beefs Up Client List

Namdia, the state-owned diamond authorized to sell 15% of rough production from the Namibian government and De Beers joint venture Namdeb, has released its updated client list, including nine Antwerp-based diamond companies last Friday. Namdia now has 36 core clients for the next three-year cycle, up from 16 in the previous years (2019-2021). Earlier this year, in February, Namibian President Hage Geingob visited the Antwerp diamond community, to discuss business opportunities.

Mountain Province Inks Deal with Chow Tai Fook, Record Sales in Antwerp

Mountain Province, holding a 49% stake in the Canadian Gahcho Kué mine, reports its latest Antwerp sales, with proceeds amounting to US$41.4m for 322,547ct, achieved a record ROM price of US$126/ct, up another 13% compared to the first sale of the year.

The company also announces a supply agreement with Chow Tai Fook, multinational jewelry retailer with presence in China, Japan, Korea, Southeast Asia and the US, providing the retailer with a select range of diamonds over a one-year, renewable term.

ALROSA Yields $325 Million In January Sales

Russian miner ALROSA announced its preliminary rough and polished sales results for January totaled $325 million. Rough diamond sales equaled $315 million and polished sales $10 million.

Grib Antwerp Sale Outperforms Dubai Sales by 35%

Closing its latest sale in Antwerp yesterday, Grib Diamonds reported selling 560,000 carats of complete mine production from the Grib Diamond Mine, for a total of US$73m. The average price was US$130/ct, up a whopping 35% compared to the recent sales results of the same production by Stargems in Dubai, which achieved US$94/ct just two weeks ago.

Grib stated to be pleased with the support of over 300 customers present in the auction, with a record demand of 174 companies placing competitive bids. There were 47 winners and a total of 4,870 bids added.

Mountain Province 2021 Results Meet Expectations, Strong Antwerp Sales in Q4

Results from Mountain Province Diamonds on Q4 and the full year (2021) reveal the miner, operating the Gahcho Kué mine in the Northwest Territories are in line with production guidance (1% below) while preliminary cost per tonne was down slightly. The miner sold 808,739 cts for US$65,7m in Q4 in Antwerp, at an impressive average of US$83/ct, well above the US$65/ct achieved in the same period in 2020.

Alrosa Optimistic About Mir Restoration and Additional Reserves

Rough & Polished reports, based on a local TV interview with CEO Sergei Ivanov, that the company is optimistic about restoration of the Mir diamond mine, and is in the final stage of a feasibility study which will determine the course of action, to be decided by a review committee in H1 of 2022.

GRIB Kicks Off 2022 With 1st Antwerp Auction

GRIB Diamonds, the Antwerp-based rough diamond selling arm of AGD Diamonds, has kicked off 2022 with its first Spot viewing for Regular Goods in Antwerp today, with the spot auction slated for January 24th. Interested parties can apply via GRIB's website to schedule an appointment.