Jewelers Report Sales Increases in March

In the the latest Monthly Sales Survey, conducted by Instore Magazine, 146 jewelers were asked to compare their March sales with those of the same month last year. While some businesses experienced significant gains, others faced challenges. Here's a breakdown of the key findings:

Sales Performance Overview:

Researchers Create LGD In 150 Minutes

The words of Botswana's President Masisi during his opening address of AWDC's Facets conference in Gaborone last year, when he described Lab-Grown Diamonds (LGD) as "microwave diamonds" come to mind as news came that South Korean scientist claim to have produced a synthetic diamond in little over two hours, using a new method that omits the need to mimic the immense pressure needed to form a diamond artificially. LGD production processes to date still require a significant amount of time to produce a diamond.

Petra Diamonds Soars with $8.2m Blue Diamond Sale

Petra Diamonds recently made headlines with the sale of an exceptional US$8.2 million blue diamond, propelling its fifth tender of FY 2024 to new heights. Despite selling fewer carats, Petra achieved higher prices, with an average of US$136 per carat on sales of 362,000 carats, totaling US$49 million.

Gem Diamonds Q1 Reports and Recoveries

Gem Diamonds, who owns 70% of the Letšeng mine in Lesotho, has released its Q1 2024 Trading Update, which showcases robust operational and sales performances from January 1st to March 31st, 2024.

Key Highlights from Q1:

De Beers' Fate Uncertain as BHP Considers Anglo American Takeover

According to Reuters, Australian mining giant BHP is contemplating a potential takeover of London-listed Anglo American, parent company of De Beers, news that is confirmed by Anglo American in a statement saying the bid is being reviewed.

3 Diamonds Fetch $10.5 Million at Lucapa Tender

ASX-listed Lucapa Diamond Company announced that three exceptional diamonds achieved US$10.5 million at the first tender of Lulo diamonds for 2024.

GJEPC Reports -25% Polished Export Drop

India's Gem and Jewellery Export Promotion Council (GJEPC) reports the overal exports of polished diamonds in FY2024 dropped 25.23% to nearly US$16bn from US$22bn in the previous financial year. GJEPC cites a slowdown in the US market due to high interest rates and slower than anticipated post-covid market conditions in China. LGD exports decreased 13.79% to US$1.4bn compared to US$1.6bn a year earlier.

(photo Envato Elements)

Namdia to Invest 3.4bnUS$ in Local Diamond Industry

Namibian Mining News reports that at Mining Indaba, Namdia has unveiled plans to invest a massive 3.4bn US$ over the next ten years, expanding its operations, including through social responsiblity actions in its "Equitable Economic Empowerment Framework" and renewing its focus on exploration, aligned with more accessible and up to date exploration licenses and mining rights information via an e-platform. Namibia, ramping up its activities in green energy rapidly, is a mineral-rich country with huge potential in critical minerals such as lithium and rare earths.

Petra Sells 50 Percent of Williamson Mine Stake for $15M

Petra Diamonds announced last week that Taifa Mining and Civils Limited, will be buying 50 per cent less one share of the Petra’s shareholding in Williamson Diamonds Limited (WDL). Tiafa Mining has been serving as the long-term technical services contractor at the Williamson Mine for over 20 years in coordination with Petra but have now stepped up their role as an equity stakeholder in the project.

NDC Brokers Partnership with 8 Key Leaders in Diamond Manufacturing

The Natural Diamond Council announced a major partnership with eight of the world’s most influential diamantaires. For the first time since the inception of the NDC (formerly the Diamond Producers Association), a collective agreement has been reached with a significant number of major businesses in the natural diamond value chain.

The World Bids Farewell to Sir Gabi Tolkowsky - A Legend and Gentle Giant

The world bids farewell to yet another giant in the diamond industry.

At 84 years of age, Sir Gabriel ‘Gabi’ Tolkowsky ends a 6-decade long career and leaves behind him a legacy that has forever reshaped the art of diamond cutting and polishing.

WDC Welcomes Feriel Zerouki as Newly Elected President

At the most recent WDC board meeting held in London, longtime diamond industry advocate and former Senior VP of Corporate Affairs at De Beers Group Feriel Zerouki has been named the new President of the World Diamond Council (WDC). Zerouki previously served as Vice President of the WDC for three years, now replacing Edward Asscher for the role of President.

David Gotlib Re-Elected as Chairman of Antwerp Beurs Voor Diamanthandel

The Antwerp Beurs Voor Diamanthandel has announced that David Gotlib has once again been re-elected as Chairman. The organization has been advocating for the promotion and protection of the interestes of its members and shareholders in the diamond sector in Antwerp since its inception in 1904.

Shanghai Diamond Price Index Officially Launched and Online

On May 5, Shanghai, at the Launch Ceremony of the “2023 Shanghai Diamond & Jewelry Culture Festival” and the “Shanghai May Shopping Festival” jointly organized by Shanghai Municipal Commission of Commerce and Pudong New Area Government, Shanghai Diamond Price Index (SDPI) was determined by the National Gems & Jewelry Testing Co. Ltd. (NGTC) jointly with Shanghai Diamond Exchange (SDE) and Gem & Jewelry Trade Association of China (GAC) officially released it.

Angolan Government Introduces New Incentivizations to Promote Benefication Manufacturing

Four incentives have been introduced by the Angolan Ministry of Mineral Resources to support beneficiation manufacturing in the country. The process works towards rewarding manufacturers and miners who take extra measures to treat materials further in their production chains. The four measures that have been introduced are as follows:

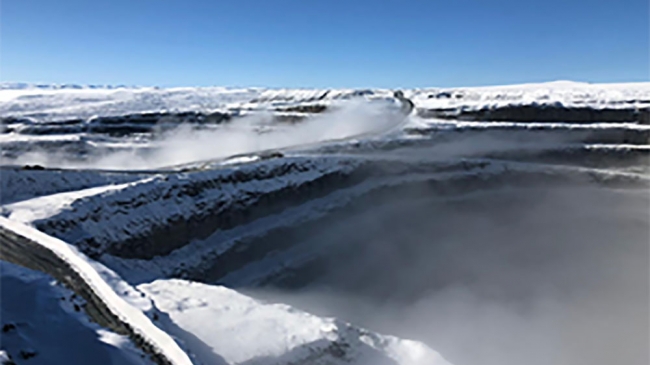

Rio Tinto’s Diavik Mine Wins Towards Sustainable Mining 2023 Award

Rio Tinto’s Diavik diamond mine in the Northwest Territories to be the recipients of this year’s Towards Sustainable Mining (TSM) Excellence Awards.

The TSM Excellence Awards were introduced in 2014 and comprise two categories: the TSM Environmental Excellence Award and the TSM Community Engagement Excellence Award. For mining companies to qualify for these awards, they must be actively applying TSM principles.

Diamcor Begins Bulk Sampling into Greater Areas of its Krone-Endora at Venetia Diamond Mine Project

Canadian mining company Diamcor announced that it will be proceeding with an extensive drilling and bulk sampling program over the greater portions of its Krone-Endora at Venetia diamond mine project.

Original Giant of Israeli Diamond Industry and Inventor Zvi Yehuda Dead at 86

Zvi Yehuda, one of the founders of the Israeli diamond industry, owner of Yehuda Diamond Company and the inventor of numerous products for the diamond trade, died Saturday at 86. He is best known for his contributions to the Israeli diamond sector by introducing the concept of selling back diamond dust to cutters and polishers for use in grinding, at only 16 years of age. Later this innovation translated into industrial diamond dust sales internationally.

There is a new Diamond Kingmaker, and it is called "Origin" : A Letter from AWDC CEO Ari Epstein

This last year in the diamond industry was not what one would consider "normal". Standard business patterns disappeared, business relationships changed drastically, and traders adapted to new regulations and ways of trading. Many of us think we have seen all the possible changes one can be faced with in a year, but I believe this is just the beginning of a paradigm shift in our industry, where quality will be replaced by a new kingmaker: origin. Heraclitus said it best: “There is nothing permanent except change”.

De Beers and Botswana Government Minister Meet with GJEPC in India to Strengthen Trade Relations

According to the GJEPC on April 18, a group from De Beers Group and and the Republic of Botswana’s minister of minerals and energy Lefoko Maxwell Moagi visited the Bharat Diamond Bourse in Mumbai. The delegation met with members of the Gem and Jewellery Export Promotion Council to discuss strengthening diamond trade ties with India. Desipite recent ongoing negotitations between the mining giant and the Botswana government regarding the renewal of their decades-long collaboration, this public display of solidarity was quite noteworthy, potentially indicating some headway on the matter.

108 Carat Fancy Intense Pink Diamond Discovered in Lesotho at SMD Kao Mine

Storm Mountain Diamonds announced yesterday the recovery of a rare fancy intense pink diamond weighing 108.39ct at its Kao mine in the Kingdom of Lesotho. The stone was discovered earlier this year on March 23rd, 2023.The exceptionally rare Type IIa gemstone is one of the largest pink diamonds in history to have been recovered.

NDC Debunks Common Myths in Diamond Industry: LGD’s Under Fire in Report

Natural Diamond Council, the authoritative resource on natural diamonds, has released its 2023 analytical report entitled, Diamond Facts: Addressing myths and misconceptions about the diamond industry. Through this report, the Natural Diamond Council (NDC) set out to address misinformation about both natural diamonds and laboratory-grown diamonds for industry players, retailers, and consumers alike.

Mountain Province Diamonds Optimistic about Kelvin and Faraday Kimberlite Studies: Over 18 million Carats Present

Mountain Province Diamonds, a 49% participant with De Beers Canada in the Gahcho Kué diamond mine located in Canada's Northwest Territories made their Q1 Reports for the spring season of 2023.

Lucapa Reports Record Numbers Once Again During Q1-2023

Angolan mining company Lucapa has posted their Q1 reports for this year with many positive highlights. At its Lulo operation, there has been a new record set in volumes mined, with an 11% increase in tonnage, resulting in over 591,00 tons processed, up from 533,000 tons processed at the same time last year. The mine also reported the recovery of a 150 carat Type IIa diamond and several fancy-colored stones - three diamonds, including two +100 carat diamonds, which will be held back from normal sale for a planned tender.

NAMDIA Establishes Formal Relations with Angolan State-Owned Companies ENDIAMA and SODIAM

The CEO of Namibia Desert Diamonds (NAMDIA) expressed interest to work with the Angolan diamond companies after a recent visit from the Angolan Minister of Mineral Resources, Petroleum and Gas, Dr Diamantino Pedro Azevedo, at the NAMDIA Headquarters. Their talks highlighted the potential Namibia and Angola has in promoting the region’s diamonds to generate even greater value for Namibia and Angola, both of which are alluvial-producing countries.

Eternal Pink Expected to Break Records at Upcoming Sotheby’s Auction

The Eternal Pink, mined by De Beers at the Damtshaa mine in Botswana is expected to fetch more than $35 million at the upcoming Sotheby’s HK auction, potentially breaking records as the most expensive price per carat ever to come to market. The estimated price per carat for The Eternal Pink is $3.3 million, giving it a chance to challenge the record set by The Williamson Pink Star, which was sold at Sotheby’s Hong Kong in 2022 for $5.2 million per carat. That gem was bought by a private collector based in the US for $57.7 million.

WIJI Renews its Commitment to SDGs and Sustainability at Geneva’s Watches and Wonders

Cartier, delegated by Richemont, and Kering launched the Watch & Jewellery Initiative 2030 driven by a common conviction that the UN Sustainable Development Goals (SDGs) and aspirations for a sustainable industry can only be achieved through collaborative initiatives. The global initiative is open to all watch and jewellery players with a national or international footprint. It is committed to a common core of key sustainability goals in three areas: building climate resilience, preserving resources, and fostering inclusiveness.

Botswana Government Announces 24% Stake Hold Investment in HB Antwerp

On 27 March, HB Antwerp officially opened the doors of HB Botswana, the company’s first branch outside Antwerp. During the inauguration ceremony, H.E. Dr. Mokgweetsi E.K. Masisi, President of Botswana, announced a strategic partnership between the Government of Botswana and HB Antwerp whereby the Government will invest in HB by acquiring a 24% equity stake in HB Antwerp.

Dholakia Foundation Dinner Affirms Diamond Industry’s Commitment to UN SDG’s

Dholakia Foundation, philanthropic arm of Hari Krishna Exports Pvt. Ltd., has been granted special accreditation to participate in the UN World Water Conference 2023. To discuss further how to achieve SDG objectives and to honor current players who have contributed with notable efforts to such goals, the organization organized a gala dinner this weekend in New York.

GEM Diamonds Remain Optimistic for 2023 Despite Share Prices Declining to Lowest Point Over Last Year

Clifford Elphick, CEO of GEM Diamonds said in an announcement on Thursday (March 16) that market volatility caused by the invasion of Ukraine by Russia contributed to a decline in diamond prices. GEM achieved an average selling price of $1,755 per carat compared to $1,835 per carat in 2021. Though he remains overall optimistic regarding the mine’s capacity to rebound during the 2023 fiscal year.

They reported a 31% decline in attributable profit for the 12 months ended December 12 of $10.2m compared to $14.8m in the previous financial year.

Petra Achieves $72.1 million in Sales in Fourth tender Cycle for FY 2023

Petra announces the results of Tender 4 of FY 2023, at which 505,398 carats were sold for a total of US$72.1 million from Petra’s South African operations.

This cycle includes a US$7 million Exceptional Stone2 from the Cullinan Mine and US$4.3 million of Finsch diamonds sold during H1 FY 2023, both of which were reported in our Interim Results announcement during February 2023. No sales for Williamson were recorded in this cycle given the operations at the mine are still suspended.

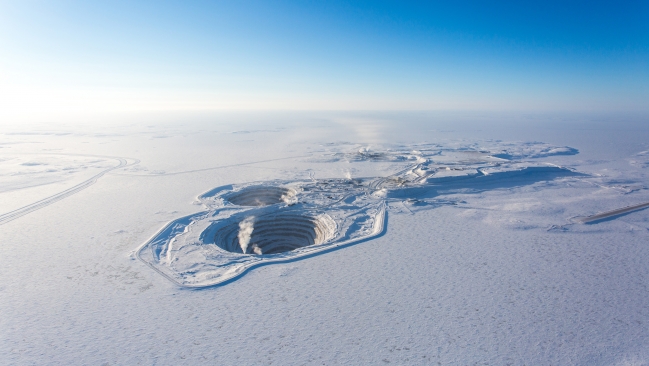

Burgundy Diamonds Acquires 100% of Artic Canadian’s Assets Including Ekati Mine

Australia-based Burgundy Diamond Mines has signed a binding share purchase agreement to acquire Canada-based Artic Canadian’s (AC) assets, including the entirety of Ekati Diamond mine, for nearly $136m. AC owns 100% of all businesses, assets and other interests comprising the producing Ekati mine in Canada’s Northwest Territories and expects the sale to result in a significant recapitalization of the firm and allow for continued operations for the Ekati Diamond Mine, which has been in production for nearly 25 years.

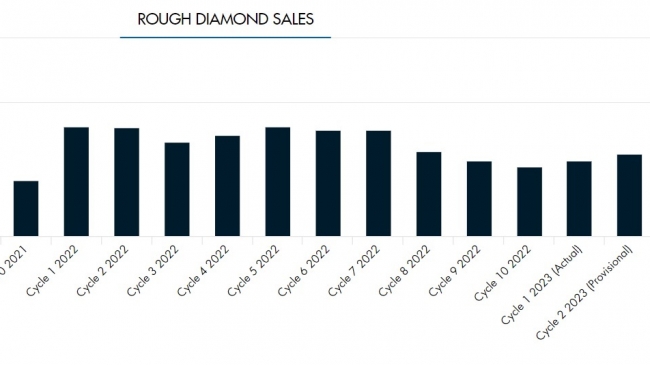

DeBeers Posts $495 Million Earnings Rough Diamond Sales in Cycle 2 - 2023

De Beers Group yesterday announced the value of rough diamond sales for the second sales cycle of 2023. The mining giant sold $495 million in rough stones. There was a noticeable year-over-year drop in sales when compared with 2022- Cycle 2, where the company sold over $652 million, a 24% fall. Sales were 9% higher than $454 million registered for the preceding first Sight of 2023.

Snap Lake Mine Enters Final Stages of Closure

De Beers’ Snap Lake diamond mine, Canada's first fully underground mine located in the Northwest Territory, is “entering the final stages of active closure” ahead of a switch to long-term monitoring. This will represent the final stages of shut down since it was decided by the company to cease operations in 2015.

Debswana and Huawei Unveil the World’s First 5G Mine

Debswana and Chinese tech giant Huawei at the Mobile World Congress Trade Show this week announced plans for the unveiling of "the world's first 5G-oriented smart diamond mine project".

The 5G network allows cutting-edge technologies like autonomous driving and enables more intelligent digital transformation of the mining industry in the years to come.

Angola Plans to Offer Tax Incentives to Attract Investment in Diamond Cutting

Angolan Minister of Mineral Resources, Oil and Gas Diamantino Azevedo has announced that the country intends to create tax incentives to attract more investors to the diamond-cutting sector.

The announcement was made over the weekend by the minister at the inauguration of the fifth diamond-cutting factory at Saurimo Diamond Development Park in the Lunda Sul province.

Homestead Diamonds Recovers Type-IIa 13-carat Pink Diamond at Samanda Mine (South Africa)

Homestead Diamonds has recovered a rare 13-carat pink diamond from its bulk sampling operation on the Samada kimberlite pipe in the Free state province of South Africa. The 13.33-carat Pink is a Type IIa diamond and is one of several exceptional fancy colour stones recovered since the commencement of the bulk sampling programme in 2020.

Rio Tinto Invests $40 Million into Underground Mining Operation at Diavik

Rio Tinto has made $40 million investment in the first phase of underground mining below the existing A21 open pit at its Diavik Diamond Mine which started commercial production in 2018 in the Northwest Territories of Canada. The Diavik mine, Canada’s largest mine produces on the order of 6.5 million carats (+/-) of rough diamonds per year and has unearthed more than 100 million carats since its opening.

Lucara Underground Mine Expansion Progresses at Karowe Mine with Anticipated Full Production by 2026

Lucara Diamond has published an updated report on the progress of its underground expansion project at Karowe diamond mine in Botswana.

The expansion will extend the life of the mine to at least 2040 and contribute $4 billion in additional revenues. Mine ramp up is expected in 2026 with full production from underground to be reached in the second half of that year.

150 Carat Diamond Recovered by Lucapa in Angola

Lucapa Diamond Company Limited together with Lulo partners, Endiama and Rosas & Petalas, have announced today the recovery of a 150-carat white Type IIa diamond from the Lulo Alluvial Mine in Angola. This stone represents the the 36th +100-carat diamond recovered at Lulo. The 150 carat diamond was recovered from Mining Block 28 (“MB28”) and is the fifth +100 carat diamond recovered from that particular mining block.

SRK Joins RJC Task Force to Tackle SDG's for Diamond Sector

Large diamond player Shree Ramkrishna Exports (SRK), has attained the Membership of the Sustainable Development Goals (SDG) and announced that the company will be joining the Task Force of the Responsible Jewellery Council (RJC).

The Task Force is a global collaborative effort to develop a systemic risk management framework that can reduce socio-economic inequalities. RJC Members commit to and are independently audited against the RJC Code of Practices – an international standard on responsible business practices for diamonds, gold and platinum group metals.

Petra Posts Interim results for the 6-Months Ending 31 Dec 2022

(PETRA PRESS RELEASE): Petra Diamonds Limited announces its unaudited interim results for the six months ended 31 December 2022.

Richard Duffy, Chief Executive Officer at Petra Diamonds commented:

Botswana Pressure Continues: DeBeers Confident Negotiations Will Come to Resolution

Botswana's President Mokgweetsi Masisi last week Sunday warned that his country may sever ties with diamond giant De Beers if talks to renegotiate a sales deal prove unfavorable to his government.

Arctic Canadian, Taché & Samir Gems Work Responsibly with Largest Fancy Vivid Yellow Diamond Ever Discovered in Canada Making History in the Process

[A DIAMOND LOUPE EXCLUSIVE STORY] - It was only just last September that Canadian mining company Arctic Canadian (AC) announced the recovery of a yellow diamond weighing an impressive 71.26 carats. The rough octahedron gem is currently the largest known fancy vivid yellow diamond ever discovered in Canada.

Rolex Officially Launches Certified Preowned Program

Rolex is offering the opportunity to purchase from its official retailers pre-owned watches that are certified as authentic and guaranteed by the brand. These timepieces benefit from the exacting quality criteria inherent to all Rolex products and from a two-year international guarantee, valid from their date of resale in the Rolex network.

De Beers Reports Increased Diamond Production in Botswana & Namibia Despite Dip in Polished Demand

Rough diamond production increased by 6% to 8.2 million carats, reflecting strong operational performance across the assets, partially offset by the planned completion of the final cut at Venetia open pit.

Sahag Arslanian Appointed VP of Armenian Jewelers Association During Key Period of Growth in Armenian Diamond Sector

Antwerp’s Sahag Arslanian joins the Armenian Jewellers Association as its newly appointed Vice President. He is currently director of the Arslanian Group as well as vice president of the Antwerp World Diamond Centre.

Petra Diamonds Solicits M&A Proposals: Open to “Consider Consolidation”

According to Reuters, Petra Diamonds invited merger and acquisition proposals on Monday, with CEO Richard Duffy saying the industry would benefit from consolidation.

"We have got opportunities to grow organically but given that we are through this restructuring and we have a much more robust balance sheet, we would be willing to consider consolidation if it makes value sense," Duffy told Reuters in an interview on the sidelines of the Investing in African Mining Indaba in Cape Town.

Botswana Expects 4% Bump in GDP Due to Strong Performance in Diamond Trade: Plans Major Infrastructure Upgrades For 2023

According to a statement released by the country’s financy minister in Gabarone, Botswana expects economic growth of 4% during 2023 while targeting medium-term growth of 5.7%. The government plans to use this windafall in proceeds to beef up infrastructural investments around the country.

Forbes: US Luxury Goods Retailers Can Expect over $5 Billion in Jewelry Sales During 2023 Valentine’s Sales Season

According to the National Retail Federation (NRF), consumer spending in the U.S. may reach as high as $25.9 billion this year on Valentine’s Day gifts ranging from gold jewellery to clothes to fine chocolates.

Of the nearly $26 billion, roughly 21% is forecast to be spent on jewellery, representing $5.5 billion. Clothing could fetch 19%, or around $5 billion.

Overall, luxury goods retailers could be headed for a strong Valentine’s sales season if estimates prove accurate.

That would make 2023 the second-best year for sales since the NRF began tracking this data.

Zimbabwe High Court Grants Release of Historic Diamond Parcel to Vast Resources in Coming Days

After a nearly 12-year negotiation, the High Court of Zimbabwe has granted a default order against the Minister of Mines and Mining Development, relating to a historic parcel of 129,400-carats of rough diamonds, which will be released to AIM UK-listed Vast Resources.

The company expects to receive the signed court order in coming days, following which Vast will clean and value the diamonds for the purpose of selling through a tender.

Vast will then determine the final quality assortment of the parcel once the diamonds are in its possession.

Tiffany & Co. Creative Director Ruba Abu-Nimah Leaves Company

Ruba Abu-Nimah, Tiffany & Co.’s executive creative director for marketing and communications has left the brand. Abu-Nimah joined the American jeweller in March 2021, reporting to Alexandre Arnault, executive vice president of product and communications, following LVMH’s takeover that January.

Her departure was first reported by Women’s Wear Daily.

IDEX: Price Report for February Indicates Price Drop in Rounds

Round prices fell yet again during January amid continued hesitancy in the markets, although fancies fared much better. Overall demand remains slow, sentiment is weak, and manufacturing in India is still well below full capacity. Estimates for the number of workers laid off in Surat vary between 10,000 and 20,000. China scrapped its zero-COVID policy in December, which has freed up trade and travel, but has seen infection levels well above anything the country has ever experienced.

De Beers Says the Diamond Industry “Remains Cautious” As Sale Values Drop Over 30%

De Beers have announced the provisional value of their first sales cycle of 2023 for rough diamond sales at $450 million. The company also confirmed actual sales for between the 5 December and the 20 December at $417 million.

The $450 million compares unfavourably to $660 million in sales revenue for the same period last year.

India Moves Forward with Policies to Bolster Local LGD Manufacturing and Research

The Indian Minister of Commerce and Industry in her Unioin Budget speech this week proposed certain budget allotments and new policies for the 23/24 fiscal year which made several provisions for the diamond sector in India who have recently suffered setbacks due to decreased exports and global market instabilities.

Debswana Sets Record with Sales of Rough Stones During 2022

Rough diamond sales by Debswana Diamond Company reached record levels in 2022 jumping up by 22% from the previous year. The jump in sales has resulted from the West’s shunning of Russian stones whereby Botswana profited from steady global demand for diamond jewellery.

Lucapa Releases Q4-2022 Results Featuring New Growth and Recovery of Special Sized Diamonds

Lucapa has released the results of its fourth quarter of activity during the last year. According to a company press release, record volumes were processed last quarter, recovering four +100 carats including several fancy-colored stones valued at over $5.9 US million were set aside for a Lulo exceptional stone tender.

Mountain Province Produced 5.52 million Carats in 2022

Mountain Province Diamonds has announced production and sales results for Q4 and 2022 from the Gahcho Kué Diamond Mine.

According to Rough & Polished, during Q4, 1,621,800 carats were recovered. For the full year 2022, 5.52 million carats were recovered (less than the guidance of 5.60 – 5.80 million carats). In 2022, approximately 2.7 million carats were sold at an average value of $112 per carat for total proceeds of $297.3 million. This compared to 3.2 million carats sold at an average value of US $75 per carat for total proceeds of US$236.9 million in FY 2021.

LVMH Sets Record Breaking Year for 2nd Year in a Row

LVMH has achieved another record year in 2022 for the second consecutive year with sales up 23% to 79 billion euros and current operating profit showing similar growth, to €21 billion, keeping in line with analysts’ projections for the luxury brand. With a valuation that recently exceeded 400 billion euros, the company gained in all sectors in its portfolio last year with particularly strong growth in the US (+15%), in Europe (+35%) and in Japan (+31%).

Rio Tinto Lowers Diavik’s 2023 Production Forecast to 3-3.8 Million Carats

Rio Tinto, which owns 100% of the Diavik Diamond Mine in the Northwest Territories in Canada, has lowered Diavik’s 2023 production forecast – from 4.5 to 5 million carats to 3 to 3.8 million carats.

According to IDEX Online, Rio Tinto “gave no explanation for the lower forecast in its fourth quarter production results.” In 2022, actual production was on target – 4.7 million carats.

The Diavik diamond mine opened in 2003 and is scheduled to close in 2025.

Source: IDEX | Israeli Diamond

Photo Credit: Rio Tinto