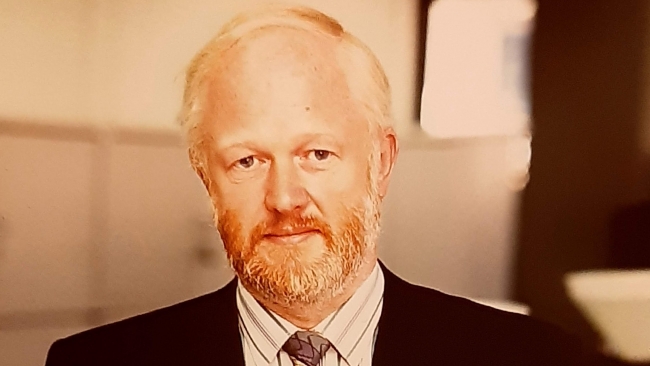

There is a new Diamond Kingmaker, and it is called "Origin" : A Letter from AWDC CEO Ari Epstein

27/04/2023 22:39

This last year in the diamond industry was not what one would consider "normal". Standard business patterns disappeared, business relationships changed drastically, and traders adapted to new regulations and ways of trading. Many of us think we have seen all the possible changes one can be faced with in a year, but I believe this is just the beginning of a paradigm shift in our industry, where quality will be replaced by a new kingmaker: origin. Heraclitus said it best: “There is nothing permanent except change”.

Market AnalysisOpinion piece