Archive

- Yesterday 11:28

ASX-listed Lucapa Diamond Company announced that three exceptional diamonds achieved US$10.5 million at the first tender of Lulo diamonds for 2024.

- 12/05/2023 10:00

Four incentives have been introduced by the Angolan Ministry of Mineral Resources to support beneficiation manufacturing in the country. The process works towards rewarding manufacturers and miners who take extra measures to treat materials further in their production chains. The four measures that have been introduced are as follows:

- 11/04/2023 13:24

The CEO of Namibia Desert Diamonds (NAMDIA) expressed interest to work with the Angolan diamond companies after a recent visit from the Angolan Minister of Mineral Resources, Petroleum and Gas, Dr Diamantino Pedro Azevedo, at the NAMDIA Headquarters. Their talks highlighted the potential Namibia and Angola has in promoting the region’s diamonds to generate even greater value for Namibia and Angola, both of which are alluvial-producing countries.

- 28/02/2023 11:13

Angolan Minister of Mineral Resources, Oil and Gas Diamantino Azevedo has announced that the country intends to create tax incentives to attract more investors to the diamond-cutting sector.

The announcement was made over the weekend by the minister at the inauguration of the fifth diamond-cutting factory at Saurimo Diamond Development Park in the Lunda Sul province. - 23/02/2023 10:36

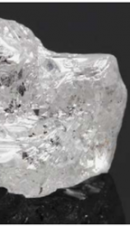

Lucapa Diamond Company Limited together with Lulo partners, Endiama and Rosas & Petalas, have announced today the recovery of a 150-carat white Type IIa diamond from the Lulo Alluvial Mine in Angola. This stone represents the the 36th +100-carat diamond recovered at Lulo. The 150 carat diamond was recovered from Mining Block 28 (“MB28”) and is the fifth +100 carat diamond recovered from that particular mining block.

- 30/01/2023 10:54

Lucapa has released the results of its fourth quarter of activity during the last year. According to a company press release, record volumes were processed last quarter, recovering four +100 carats including several fancy-colored stones valued at over $5.9 US million were set aside for a Lulo exceptional stone tender.

- 27/07/2022 10:25

Australian miner Lucapa discovered a massive 170ct pink diamond at its Angolan Lulo mine, believed to be the largest pink recovered in the past 300 years. The incredibly rare find is named "The Lulo Rose".

- 17/06/2022 06:14

The Financial Times reports that the Angolan Government has blocked and taken over the 18% stake of the Chinese company LLI (part of Sonangol) in Catoca. The Government now holds 59% of shares in Angola’s largest mine through IGAPE, the state body managing govt shareholding in companies active in the country. The move is considered another step in President Lourenço’s reform policy, reducing the interdependence with China that was established under the Dos Santos regime, when deals between Angola and China, especially in the oil business, were booming.

- 22/04/2022 17:32

Iconic diamond miner De Beers this week now officially returns to Angola, as the Anglo American diamond mining division signed two mineral investment deals with the State's mining entity Endiama, giving the miner exploration rights for 35 years in the Northeast of the country. Each exploration concession will have a separate joint venture, with the majority of shares held by De Beers, with an option for Endiama to increase it's share.