Archive

- 01/12/2022 14:14

Newfield Resources has entered into an asset purchase and sales agreement with DelGatto Diamond Finance Fund (DDFF) for an initial amount of $1.2-million (before costs), payable within 12 months from future diamond sales, to assist with the continued development of the company’s Tongo diamond mine, in Sierra Leone, and for general working capital.

Newfield took over Tongo in March 2018 when it acquired London-based Stellar Diamonds for $23.6m. Before that the mine was owned by Israeli diamantaire Beny Steinmetz, through Koidu Holdings, in which he held a controlling stake. - 07/06/2022 06:20

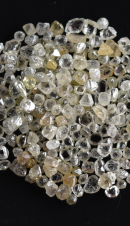

Australia-based Newfield Resources, concluded its maiden sale of 5333ct rough produced in the miner’s Sierra Leone Tongo mine, via Antwerp tender specialist Bonas Group successfully, with total revenues amounting to US$1.44m. Strong demand pushed prices for the 15 trial sale lots to an average of US$269/ct, well over Newfields estimation of US$222/ct. Newfield will conduct more sales this year as the company starts production at two of the five identified kimberlites on the Tongo mining leases.

- 02/05/2022 16:29

Australian diamond exploration and development company Newfield announced they signed an exclusive diamond sales and marketing agreement with the Bonas Group. Newfield’s flagship asset is the Tongo Mine Development in eastern Sierra Leone.

Through this partnership, Newfield will be able to fully authenticate the source of the Tongo diamonds sold, via the Sarine Technologies traceability program used by Bonas. Buyers and retailers of those goods will therefore have full traceability of the diamonds’ origin.