Archive

- 07/02/2023 16:32

According to Reuters, Petra Diamonds invited merger and acquisition proposals on Monday, with CEO Richard Duffy saying the industry would benefit from consolidation.

"We have got opportunities to grow organically but given that we are through this restructuring and we have a much more robust balance sheet, we would be willing to consider consolidation if it makes value sense," Duffy told Reuters in an interview on the sidelines of the Investing in African Mining Indaba in Cape Town.

- 07/02/2023 16:09

According to a statement released by the country’s financy minister in Gabarone, Botswana expects economic growth of 4% during 2023 while targeting medium-term growth of 5.7%. The government plans to use this windafall in proceeds to beef up infrastructural investments around the country.

- 07/02/2023 16:06

According to the National Retail Federation (NRF), consumer spending in the U.S. may reach as high as $25.9 billion this year on Valentine’s Day gifts ranging from gold jewellery to clothes to fine chocolates.

Of the nearly $26 billion, roughly 21% is forecast to be spent on jewellery, representing $5.5 billion. Clothing could fetch 19%, or around $5 billion.Overall, luxury goods retailers could be headed for a strong Valentine’s sales season if estimates prove accurate.

That would make 2023 the second-best year for sales since the NRF began tracking this data. - 06/02/2023 12:18

After a nearly 12-year negotiation, the High Court of Zimbabwe has granted a default order against the Minister of Mines and Mining Development, relating to a historic parcel of 129,400-carats of rough diamonds, which will be released to AIM UK-listed Vast Resources.

The company expects to receive the signed court order in coming days, following which Vast will clean and value the diamonds for the purpose of selling through a tender.

Vast will then determine the final quality assortment of the parcel once the diamonds are in its possession. - 06/02/2023 11:37

Ruba Abu-Nimah, Tiffany & Co.’s executive creative director for marketing and communications has left the brand. Abu-Nimah joined the American jeweller in March 2021, reporting to Alexandre Arnault, executive vice president of product and communications, following LVMH’s takeover that January.

Her departure was first reported by Women’s Wear Daily.

- 03/02/2023 17:41

Round prices fell yet again during January amid continued hesitancy in the markets, although fancies fared much better. Overall demand remains slow, sentiment is weak, and manufacturing in India is still well below full capacity. Estimates for the number of workers laid off in Surat vary between 10,000 and 20,000. China scrapped its zero-COVID policy in December, which has freed up trade and travel, but has seen infection levels well above anything the country has ever experienced.

- 03/02/2023 17:33

De Beers have announced the provisional value of their first sales cycle of 2023 for rough diamond sales at $450 million. The company also confirmed actual sales for between the 5 December and the 20 December at $417 million.

The $450 million compares unfavourably to $660 million in sales revenue for the same period last year.

- 03/02/2023 17:21

The Indian Minister of Commerce and Industry in her Unioin Budget speech this week proposed certain budget allotments and new policies for the 23/24 fiscal year which made several provisions for the diamond sector in India who have recently suffered setbacks due to decreased exports and global market instabilities.

- 02/02/2023 10:45

Rough diamond sales by Debswana Diamond Company reached record levels in 2022 jumping up by 22% from the previous year. The jump in sales has resulted from the West’s shunning of Russian stones whereby Botswana profited from steady global demand for diamond jewellery.

- 30/01/2023 10:54

Lucapa has released the results of its fourth quarter of activity during the last year. According to a company press release, record volumes were processed last quarter, recovering four +100 carats including several fancy-colored stones valued at over $5.9 US million were set aside for a Lulo exceptional stone tender.

- 30/01/2023 10:23

Mountain Province Diamonds has announced production and sales results for Q4 and 2022 from the Gahcho Kué Diamond Mine.

According to Rough & Polished, during Q4, 1,621,800 carats were recovered. For the full year 2022, 5.52 million carats were recovered (less than the guidance of 5.60 – 5.80 million carats). In 2022, approximately 2.7 million carats were sold at an average value of $112 per carat for total proceeds of $297.3 million. This compared to 3.2 million carats sold at an average value of US $75 per carat for total proceeds of US$236.9 million in FY 2021.

- 30/01/2023 10:13

LVMH has achieved another record year in 2022 for the second consecutive year with sales up 23% to 79 billion euros and current operating profit showing similar growth, to €21 billion, keeping in line with analysts’ projections for the luxury brand. With a valuation that recently exceeded 400 billion euros, the company gained in all sectors in its portfolio last year with particularly strong growth in the US (+15%), in Europe (+35%) and in Japan (+31%).

- 27/01/2023 12:17

Rio Tinto, which owns 100% of the Diavik Diamond Mine in the Northwest Territories in Canada, has lowered Diavik’s 2023 production forecast – from 4.5 to 5 million carats to 3 to 3.8 million carats.

According to IDEX Online, Rio Tinto “gave no explanation for the lower forecast in its fourth quarter production results.” In 2022, actual production was on target – 4.7 million carats.

The Diavik diamond mine opened in 2003 and is scheduled to close in 2025.Source: IDEX | Israeli Diamond

Photo Credit: Rio Tinto - 27/01/2023 11:51

The RJC has announced the appointment of writer and journalist Melanie Grant as the new executive Director of the organization. After several changes in the 2022 fiscal year, Grant’s appointment to the position represents the 3rd of such occurrences in under 12 months.

- 25/01/2023 12:00

After a 3-year pause due to Covid-19, Israel International Diamond Week is finally back, launching its next edition from March 27 – 30, 2023. The event will feature a much-anticipated tender of polished goods held at the Israel Diamond Exchange’s International Tender Center. The tender will be conducted by Diagurus from March 26 – 30, 2023.

- 25/01/2023 11:20

In the fully packed Teatro Palladio at Vicenzaoro, the reinvented design competition came to its conclusion with the announcement of winners in 3 design categories and the Global Winner of the overall competition. That ¬final honor falls upon the young and new talent Wang Xuerui from China. HRD CEO Ellen Joncheere also launched a new initiative to support young designers worldwide: the young Designers Community.

- 24/01/2023 17:09

Belgium based company Signum who was known for pioneering on the NFT side of the diamond trade developing a blockchain style ledger to prove diamond authenticity, now intends on incorporating the sale of rough stones directly to the public along with its digital companion into their business model.

“We are aiming to create a new product and a new market,” Rafael Papismedov, co-founder and managing partner of Signum.

- 19/01/2023 13:13

The Bank of Tanzania announced that the country’s diamond exports increased significantly to $63.1 million (USD) in value by November 2022. This is more than seven times of the $8.4 million export value that was recorded in the year-over year analysis since November 2021.

- 18/01/2023 11:52

Amid the threat of a looming financial recession for the diamond sector in Surat, the GJEPC now seeks a new series of policies they believe will add to manufacturing revenues. This has been another of a late series of attempts by the GJEPC to counter-act the pressures facing India’s diamond sector since the decline of Russian imports and the closure of the Chinese marketplace.

- 16/01/2023 12:27

Lucapa Diamond Company Limited together with their Project Lulo partners, Endiama and Rosas & Petalas, have recovered a total of 41 diamonds weighing 66.05 carats in a recent kimberlite sample.

The sample also includes two special sized diamonds weighing 15.27 and 12.37 carats, with 12 diamonds greater than one carat recovered totaling of 50.21 carats.

- 16/01/2023 12:01

Sarine Technologies has signed a strategic cooperation agreement with the Delgatto Diamond Finance Fund (DDFF) that will enable DDFF to “significantly” increase the amount of capital it provides to the rough sector, as well as expand the types of structures it offers enable more efficient rough diamond financing, starting from January 15th.

- 13/01/2023 11:21

This year Lebanese Jeweler Fred Mouawad unveiled the newly crafted crown for the Miss Universe pageant following a 3-year partnership with The Miss Universe Organization.

Commenting on the relationship between the two entities, the jeweler stated, “the creative partnership draws on Mouawad’s strong heritage of designing jewellery for royalty and its reputation for crafting the extraordinary to craft exceptional, one-of-a-kind pieces befitting modern-day royalty.” - 13/01/2023 11:10

The Chinese conglomerate Fosun, best known as being the largest shareholder of insurer Ageas, is considering selling its majority stake in International Gemological Institute (IGI). The deal could value the Antwerp-based diamond evaluator at around 200 million euros, the Bloomberg news agency learned from sources close to the file.

In October, Fosun announced that it plans to sell up to $11 billion in assets to improve its liquidity position. In addition, Fosun would now, together with Deutsche Bank, evaluate the possibility of selling its 80 percent stake in IGI. - 11/01/2023 10:04

De Beers Group today announced that Stephen Lussier, De Beers Group Executive Vice President for Brands & Consumer Markets, will step down from his executive responsibilities on 1 April 2022 after 37 years with the company. Lussier will continue to contribute to De Beers as a strategic advisor and will continue to serve in his role as Chairman of the Natural Diamond Council.

- 09/01/2023 14:22

India’s gem and jewellery exports have seen an increase of 8.26 percent in the current financial year, thanks in part to the Comprehensive Economic Partnership Agreement (CEPA). The Indian government has taken several steps to support the gem and jewellery industry, including the implementation of a simplified regulatory framework for exports through e-commerce, reduced duties for the import of diamonds and a new gold monetization policy.

- 06/01/2023 15:14

Citing plummeting demand for cut and polished diamonds in the West and China, the Surat Diamond Association has published a report that over 20,000 workers have been put out of work in the last one month in Surat, India.

- 05/01/2023 11:25

The IIJS Signature expo returns to Mumbai this year after starting today January 5th going through the 9th. The expo organized by the GJEPC is taking every effort to make the show bigger, better and greener, expecting over 30,000 visitors to this year’s event. The expo plans to be carbon-neutral by 2025-26 and this expo is the first effort in that direction.

- 05/01/2023 11:05

BlueRock Diamonds says it has finally gotten through the last of the problems that cut its processing production by over 30% caused by unseasonable rains that flooded the country last

April and again in October through November. In an update posted by London-based miner the company confirmed it was now back to normal production levels, even during a particularly rainy fourth quarter. - 02/01/2023 15:34

Botswana Diamonds (BOD), the UK-based explorer, says it is seeking joint venture opportunities to seek out new assets in Zimbabwe and South Africa in the new year.

Speaking of Zimbabwe, John Teeling, chairman of BOD, said in a trading update: “There are significant geological opportunities in the country. The objective is to find a formula, which suits all parties.” - 02/01/2023 15:13

Global diamond group DeBeers has reported an over 20% bump in auction sales towards the closing of the 2022 sales year during its 10th and final yearly sales cycle. The mining and trading firm sold £340million of the gems at its auction in December – up from £279million in December 2021.

Before the pandemic, diamond prices were falling as the market struggled with oversupply, economic slowdown in China, and a global squeeze on luxury goods spending. The estimated sales at the December auction were down 10 per cent on the November auction, where the firm made £377million.

- 23/12/2022 16:21

Deloitte, in a recent survey study indicates that there will be a significant increase in watch sales this coming year, with growth in online purchases along with shoppers looking for pre-owned watches in efforts at finding more sustainable consumer solutions.

- 22/12/2022 15:48

Chroma Diamonds founded by Alexander Appels and Jan De Henau is a relatively new company in the Antwerp diamond district, which specializes in colored diamonds. Stymied by the relatively “subjective process of color grading”, the 2 have set out on a mission to develop a device that provides more objective measurements for the grading of colored stones.

- 22/12/2022 10:17

Anglo American PLC said Wednesday that rough-diamond sales by its majority-owned De Beers Group fell in 2022's 10th sales cycle compared with the previous cycle.

The FTSE 100 mining company said De Beers sold $410 million worth of diamonds in the 10th sales cycle of the year compared with $454 million in the ninth cycle. In the 10th cycle of 2021, it sold $336 million worth of diamonds. - 21/12/2022 15:36

According to market analysis firm Seeking Alpha, Signet’s management seems to be doing all the right things - whether it's making smart acquisitions, divesting a risky sub-prime financing business, shutting underperforming stores, or maintaining strong margins.

- 20/12/2022 12:35

India’s Ministry of Finance has amended the ‘Exports by Post’ Regulations 2018 respectively for allowing postal authorities to set up, operate and maintain the PBE (Postal Bill of Export) Automated System for filing of electronic declaration for export of goods through Post.

- 19/12/2022 09:35

The Italian Exhibition Group is holding the annual jewelry trade show at the Vicenza Expo Centre in Italy, from Jan. 20-24, alongside T. Gold, the technology and machinery show. More than an estimated 1,200 brands from 33 countries will be present at the event, featuring a mix of new and returning jewelry designers.

VO Vintage, IEG’s vintage watch and jewelry show, will also return from Jan. 20-23, and is open to the public.

The show will welcome back key brands, including Damiani, Roberto Coin, and Crivelli as well as Fope, Leo Pizzo, Annamaria Cammilli, and Crieri.

- 16/12/2022 14:05

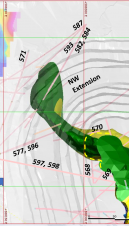

The Hearne kimberlite is one of four kimberlites being mined at Gahcho Kué Mine, which is presently ranked as 4th in the world by annual diamond production. Mountain Province is a 49% shareholder at Gahcho Kué with joint venture partner De Beers Canada as operators.

- 15/12/2022 09:30

Jewelry trade publications such as JCK are reporting ever more instances of lab-grown diamonds bearing fraudulent inscriptions linked to grading reports for natural gems. “Given that the resale value of lab-grown diamonds is next to nothing,” said Soraya Cayen, owner of the Carmel, CA. jewelry salon, Cayen Collection, “retailers and consumers alike are understandably seeking confirmation that their diamond is a naturally mined one.”

- 14/12/2022 13:25

Petra announces the results of Tender 3 of FY 2023, at which 305,366 carats were sold for a total of US$42.3 million across Petra’s mining operations.

“Petra’s third tender for FY 2023 saw a 2.2% increase in like-for-like prices on Tender 2 FY 2023, reversing the downward trend observed in the previous two tenders. Although it is still too early to speculate on whether rough diamond prices have bottomed out, we are very satisfied with the overall result, “said Richard Duffy, CEO of Petra. - 13/12/2022 09:59

The IDEX Polished Price Index reported a 2.62% decline in November, standing at 132.76 – “its biggest monthly drop since April of this year.” According to the analysis, several factors are “dampening demand and squeezing prices” – uncertainties over the US economy, EU Recession fears for Q-4, the war in Ukraine and China’s Covid lockdowns along with the protests against them.

- ‹ previous

- 2 of 5

- next ›